标题党了。这里就不直接说IUL了,毕竟IUL作为保险产品,有其保险产品如传承、避税、资产隔离等特性,不好直接和投资对比。这里仅仅对比投资策略的收益。

☂️ 保底和封顶的底层投资策略

IUL的保底和封顶投资策略,可以对应downside protected portfolio(下行保护的投资组合):

❝ 下行保护是指在投资过程中采用某些技术手段,以减缓或防止投资价值下跌。常见的下行保护方法包括使用止损单、期权合约,或其他对冲工具,以为单个投资或整个投资组合提供防御机制。❞

✍🏻 不计算费用的情况下历史数据回测对比

对比三种投资策略如下:

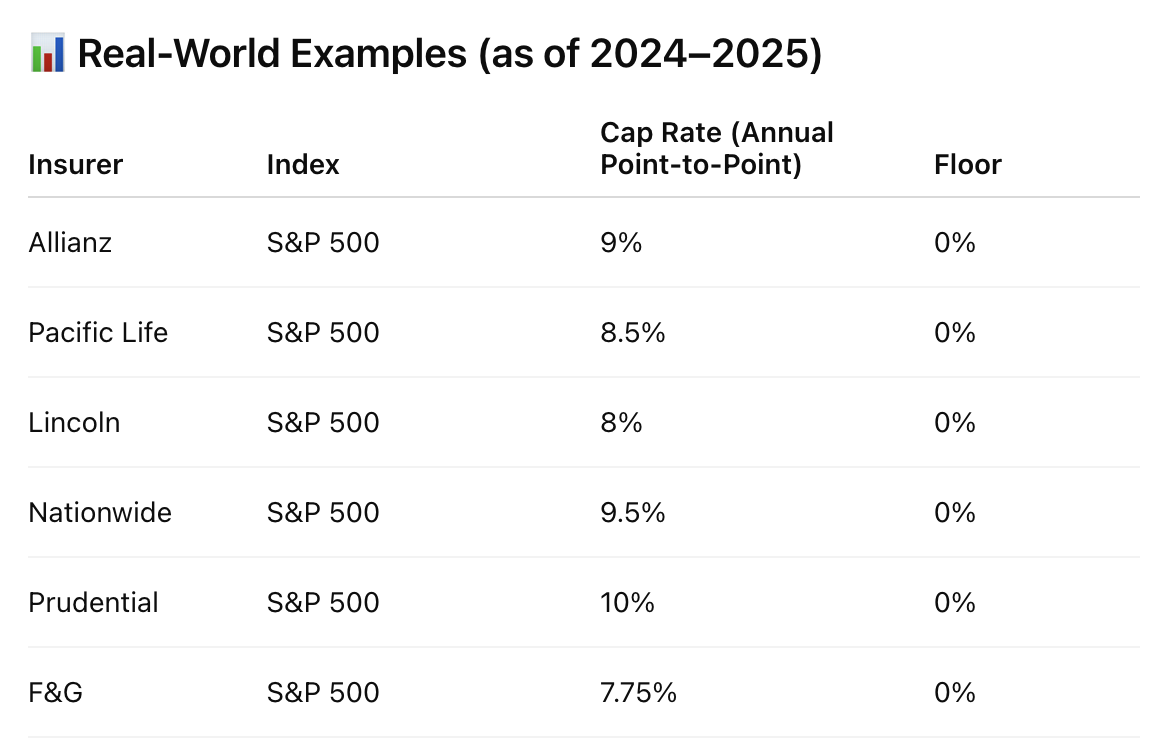

❶ 下行保护的投资组合 (floor 0%~cap 9%,数据参考如图)

❷ 直接投资指数承受波动

❸ 低波动的替代投资策略:股债40/60投资组合(假设4%无波动债券收益)

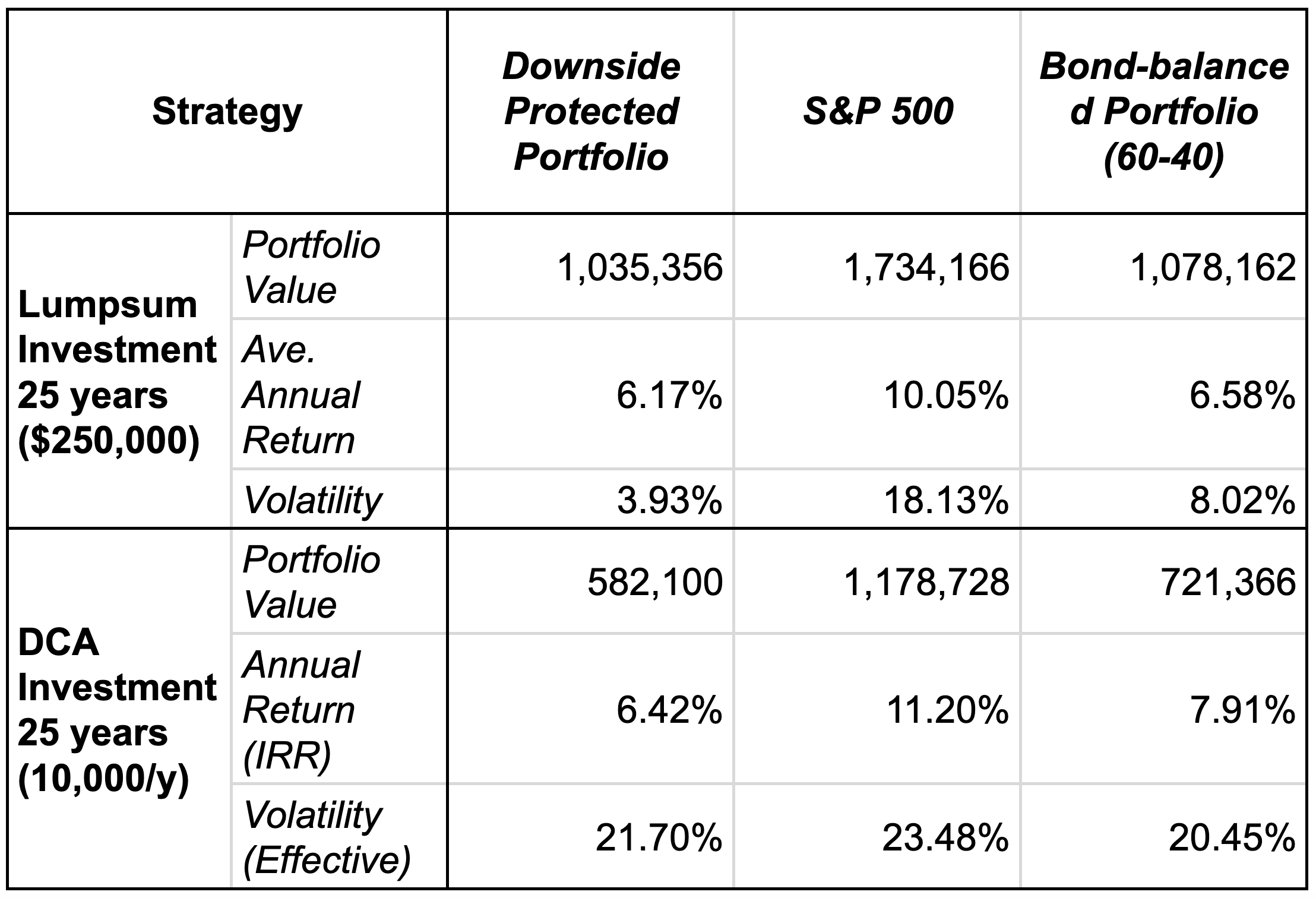

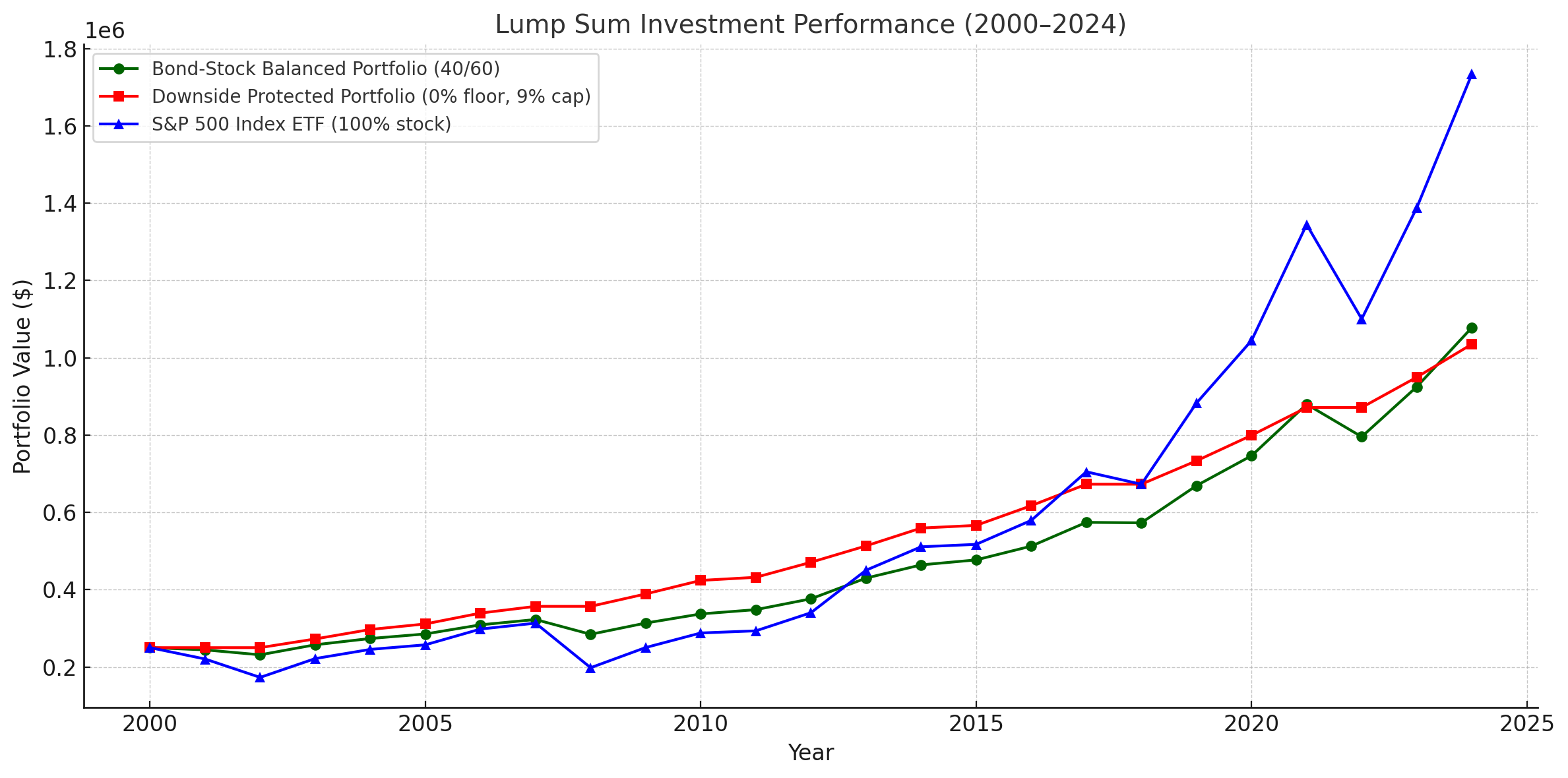

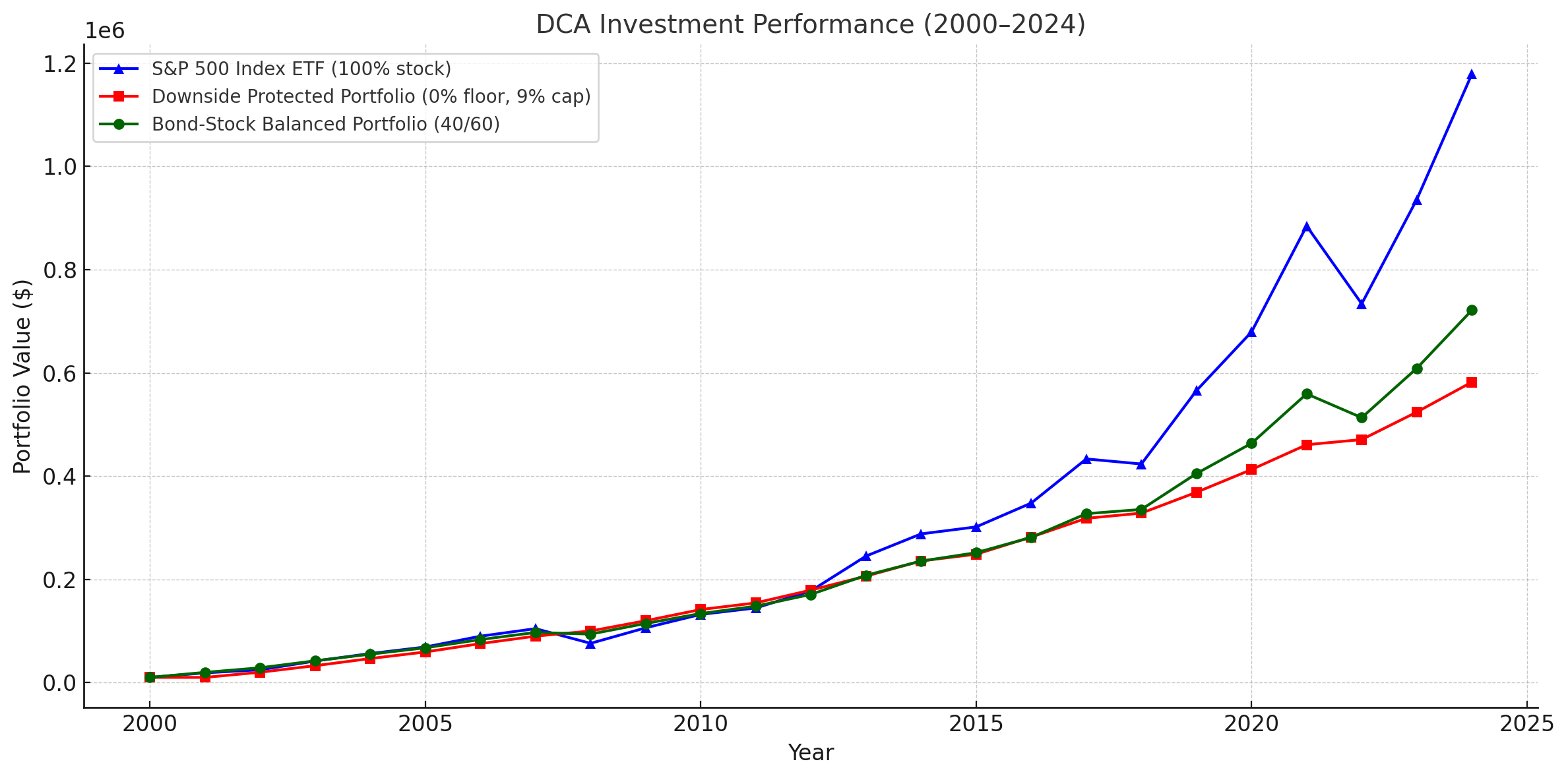

按一次性投资和年定投两种方式回测投资S&P500指数25年的收益对比(这里没有计算费率。下行保护的投资组合组合毕竟使用了期权衍生品等复杂策略,相比被动指数基金费率肯定更高):

计算脚本 (展开查看)

import yfinance as yf

import pandas as pd

import numpy as np

import numpy_financial as npf

import matplotlib.pyplot as plt

# Parameters

ticker = 'SPY'

start_year = 2000

end_year = 2024

# Fetch SPY historical data

data = yf.download(ticker, start=f'{start_year}-01-01', end=f'{end_year+1}-01-01')

data = data['Close']['SPY'].resample('Y').last() # Year-end adjusted close prices

def sp_500(init_amount, annual_investment):

# Initialize tracking

units_owned = init_amount / data[0]

total_invested = init_amount

portfolio_values = []

prices = []

for price in data:

units_bought = annual_investment / price

units_owned += units_bought

total_invested += annual_investment

portfolio_value = units_owned * price

prices.append(price)

portfolio_values.append(portfolio_value)

cash_flows = [-annual_investment] * 25

cash_flows[-1] += portfolio_values[-1] # Final value added in last year

# Calculate returns

irr = npf.irr(cash_flows)

returns = pd.Series(portfolio_values).pct_change().dropna()

average_return = returns.mean() if math.isnan(irr) else irr

volatility = returns.std()

# Build result DataFrame

df = pd.DataFrame({

'Year': list(range(start_year, start_year + len(prices))),

'SPY Price': prices,

'Portfolio Value': portfolio_values

})

# Print results

print(f"\nSummary for S&P 500 with {init_amount} initial investment and {annual_investment} annual investment:")

print(f"Total Invested: ${total_invested:,.2f}")

print(f"Final Portfolio Value: ${portfolio_values[-1]:,.2f}")

print(f"Average Annual Return: {average_return:.2%}")

print(f"Annual Volatility: {volatility:.2%}")

return df

def downside_protected(init_amount, annual_investment):

cap = 0.09

floor = 0.00

# Calculate actual yearly returns

returns = data.pct_change().dropna()

# Apply IUL-style return constraints

capped_returns = returns.clip(lower=floor, upper=cap)

# Simulate portfolio with yearly investment and capped returns

portfolio_values = []

current_value = init_amount

total_invested = current_value

for r in capped_returns:

current_value = (current_value + annual_investment) * (1 + r)

total_invested += annual_investment

portfolio_values.append(current_value)

# Add first year manually (no return applied yet)

portfolio_values = [init_amount + annual_investment] + portfolio_values

total_invested += annual_investment

cash_flows = [-annual_investment] * 25

cash_flows[-1] += portfolio_values[-1] # Final value added in last year

# Build DataFrame

df = pd.DataFrame({

'Year': list(range(start_year, end_year + 1)),

'Capped Return': [0.0] + list(capped_returns),

'Portfolio Value': portfolio_values

})

# Calculate stats

irr = npf.irr(cash_flows)

final_value = portfolio_values[-1]

avg_return = capped_returns.mean() if math.isnan(irr) else irr

volatility = pd.Series(portfolio_values).pct_change().std() if annual_investment > 0 else capped_returns.std()

# Print results

print(f"\nSummary for downside protected portfolio with {init_amount} initial investment and {annual_investment} annual investment:")

print(f"Total Invested: ${total_invested:,.2f}")

print(f"Final Portfolio Value: ${final_value:,.2f}")

print(f"Average Annual Return (Effective): {avg_return:.2%}")

print(f"Volatility (Effective): {volatility:.2%}")

return df

def bond_balanced(init_amount, annual_investment):

stock_ratio = 0.4

bond_ratio = 1 - stock_ratio

bond_return = 0.04 # 4% fixed annual return

# Calculate SPY annual returns

stock_returns = data.pct_change().dropna()

# Initialize portfolio values

total_invested = init_amount

stock_value = total_invested * stock_ratio

bond_value = total_invested * bond_ratio

portfolio_values = []

# Simulate year by year

years = list(range(start_year, end_year + 1))

portfolio_values.append(init_amount + annual_investment) # Year 2000 (first investment)

stock_value += annual_investment * stock_ratio

bond_value += annual_investment * bond_ratio

total_invested += annual_investment

for r in stock_returns:

# Apply returns

stock_value *= (1 + r)

bond_value *= (1 + bond_return)

# Add new investment

stock_value += annual_investment * stock_ratio

bond_value += annual_investment * bond_ratio

total_invested += annual_investment

total_portfolio = stock_value + bond_value

portfolio_values.append(total_portfolio)

cash_flows = [-annual_investment] * 25

cash_flows[-1] += portfolio_values[-1] # Final value added in last year

# Calculate stats

irr = npf.irr(cash_flows)

returns = pd.Series(portfolio_values).pct_change().dropna()

average_return = returns.mean()

volatility = returns.std() if math.isnan(irr) else irr

# Build DataFrame

df = pd.DataFrame({

'Year': years,

'Portfolio Value': portfolio_values

})

# Output

print("\nSummary:")

print(f"Total Invested: ${total_invested:,.2f}")

print(f"Final Portfolio Value: ${portfolio_values[-1]:,.2f}")

print(f"Average Annual Return: {average_return:.2%}")

print(f"Annual Volatility: {volatility:.2%}")

return df

def plog_data(title, df_sp500, df_downside_protected, df_bond_balanced):

plt.figure(figsize=(10, 6))

plt.title(title)

plt.xlabel("Year")

plt.ylabel("Portfolio Value ($)")

plt.grid(True)

plt.tight_layout()

plt.plot(df_sp500['Year'], df_sp500['Portfolio Value'], marker='o', label='S&P 500')

plt.plot(df_downside_protected['Year'], df_downside_protected['Portfolio Value'], marker='x', label='Downside Protected')

plt.plot(df_bond_balanced['Year'], df_bond_balanced['Portfolio Value'], marker='s', label='Bond Balanced')

plt.legend(loc="upper left")

plt.show()

# Calculate and Plot Lumpsum investment strategy:

plog_data("Lumpsum Investment Performance (2000-2024)",

sp_500(250_000, 0),

downside_protected(250_000, 0),

bond_balanced(250_000, 0))

# Calculate and Plot DCA investment strategy:

plog_data("DCA Investment Performance (2000-2024)",

sp_500(0, 10_000),

downside_protected(0, 10_000),

bond_balanced(0, 10_000))

💭 结论

收益和波动率成正比这个理论仍然适用。不愿承担市场风险,自然就放弃了一部分高收益。

一次性大额投资的设定下,下行保护的投资组合在市场震荡时有一定优势,波动率低并且保证本金不亏损。对于有短期流动性需求或投资期限较短的投资者来说,这是合理的选择。

但使用定投策略时,下行保护的投资组合就没有什么优势了。在市场下跌时,定投使得购入成本也降低。下行保护的投资组合的有效波动率并不比直接投资股指低多少,并且高于股债平衡投资组合,但是长期收益明显不如两者。

从滚动一年期的表现来看,S&P500最常见的年回报区间为10%到20%,这已经高于当前下行保护的投资组合所设定的年化回报上限。在回报上限之下的“机会成本”是巨大的,尤其是在长期持有中,这种差距将会被复利效应不断放大。

免责声明: 这个博客中的内容仅供信息参考,不旨在提供个人财务建议。请在进行尽职调查后做出您的财务决策。