Before reading In pursuit of the perfect portfolio, I had already explored and learned about several foundational investment theories through other means—and used them to shape my own portfolio. Conveniently, the first four chapters of the book cover the lives, theories, and portfolio philosophies of four iconic figures in the world of finance.

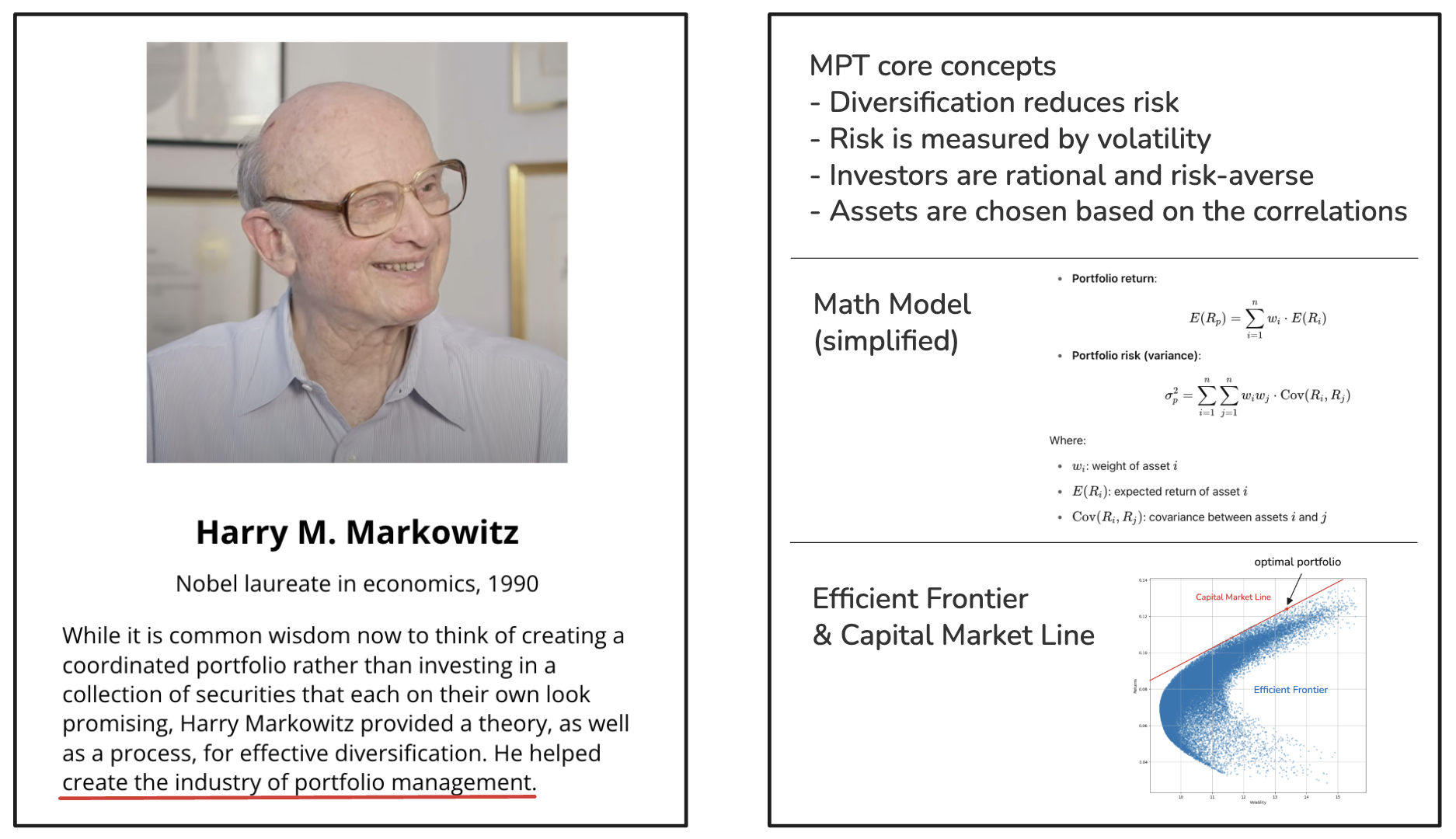

MPT - A Balanced Stock-Bond Strategy

Nobel laureate Harry Markowitz introduced the Modern Portfolio Theory (MPT) in 1952. His theoretical framework and mathematical model laid the foundation for the modern asset management industry.

❝ At that time, I thought if the stock market goes up and I’m completely out of it, then I’ll look silly. And if it goes down and I’m 100 percent in it, I’ll look silly. So I went fifty-fifty. So, I was, at that time, minimising maximum regret.

That’s what I did in 1952, but that’s not what I would do today and is not what I would recommend a 25-year old do now. Now, I’d probably put them 100 percent in stocks.

I know from repeated exposure the approximate asset class mix I prefer, and I invest in that mix, roughly. I implement my choice with ETFs for equities and with individual bonds for fixed income. ——Harry Markowitz ❞

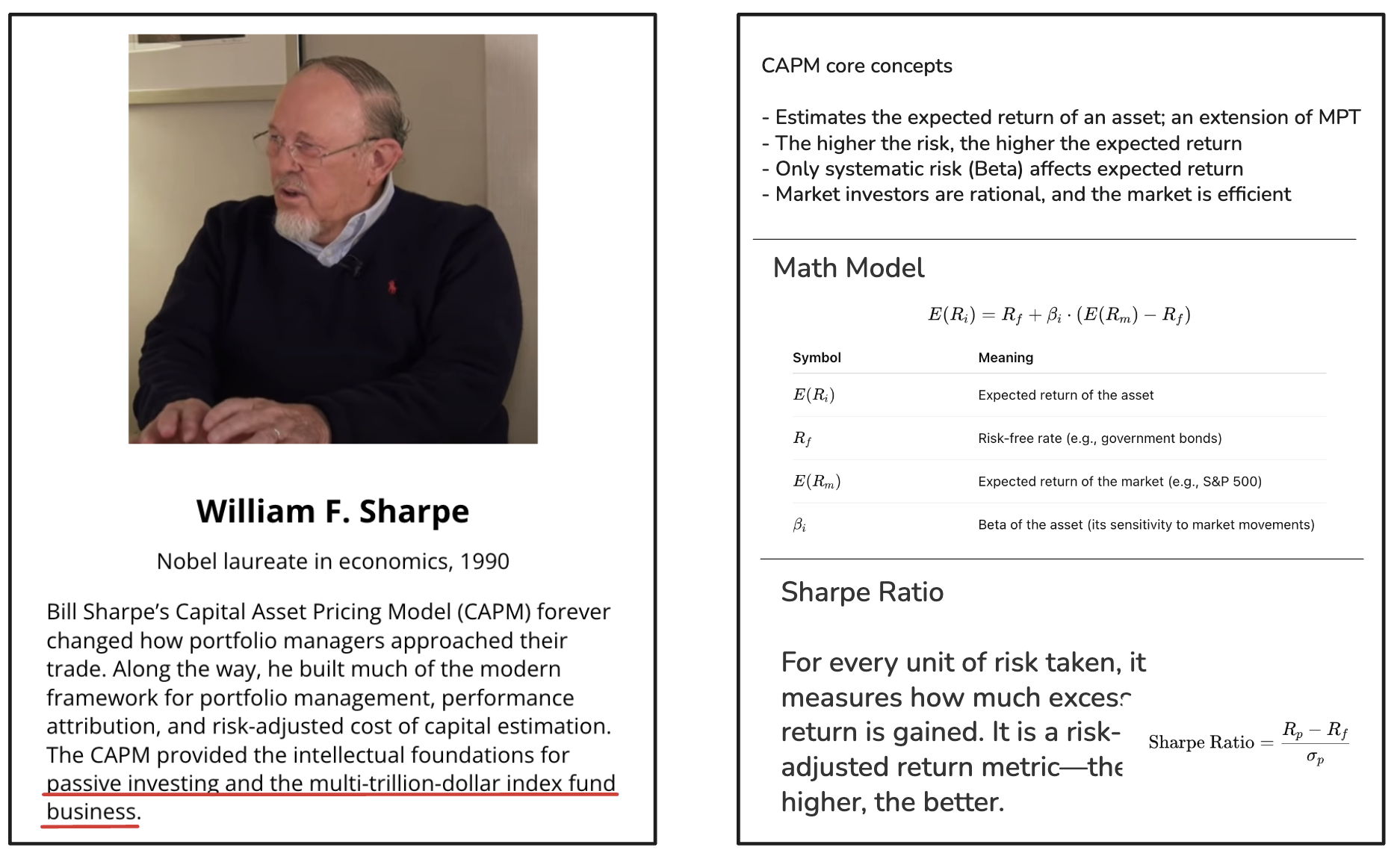

CAPM - Risk and Expected Returns Go Hand in Hand

Nobel laureate William Sharpe developed the Capital Asset Pricing Model (CAPM) in 1964. It formalized the relationship between risk and expected return.

❝ Ideally, it would be a combination of a riskless real portfolio, something like TIPS and all the tradable bonds and stocks in the world in market proportions. I looked at various index funds, ETFs, with a very, very careful eye on expense ratios, because expense ratios, as you know, can add up hugely.

I put some of my money in this exact portfolio. It has four components, the reason it’s four is the fees are lower if you use these four than some other. They all happen to be Vanguard. They are a US total stock market fund, a non-US, a US total bond market fund and a then a non-US total bond market fund.

That’s how you invest, but you’ve got to save enough first. Most people, many people, are not. You’ve just got to save an awful lot, because nobody else is going to do it for you, except Social Security. ——William Sharpe ❞

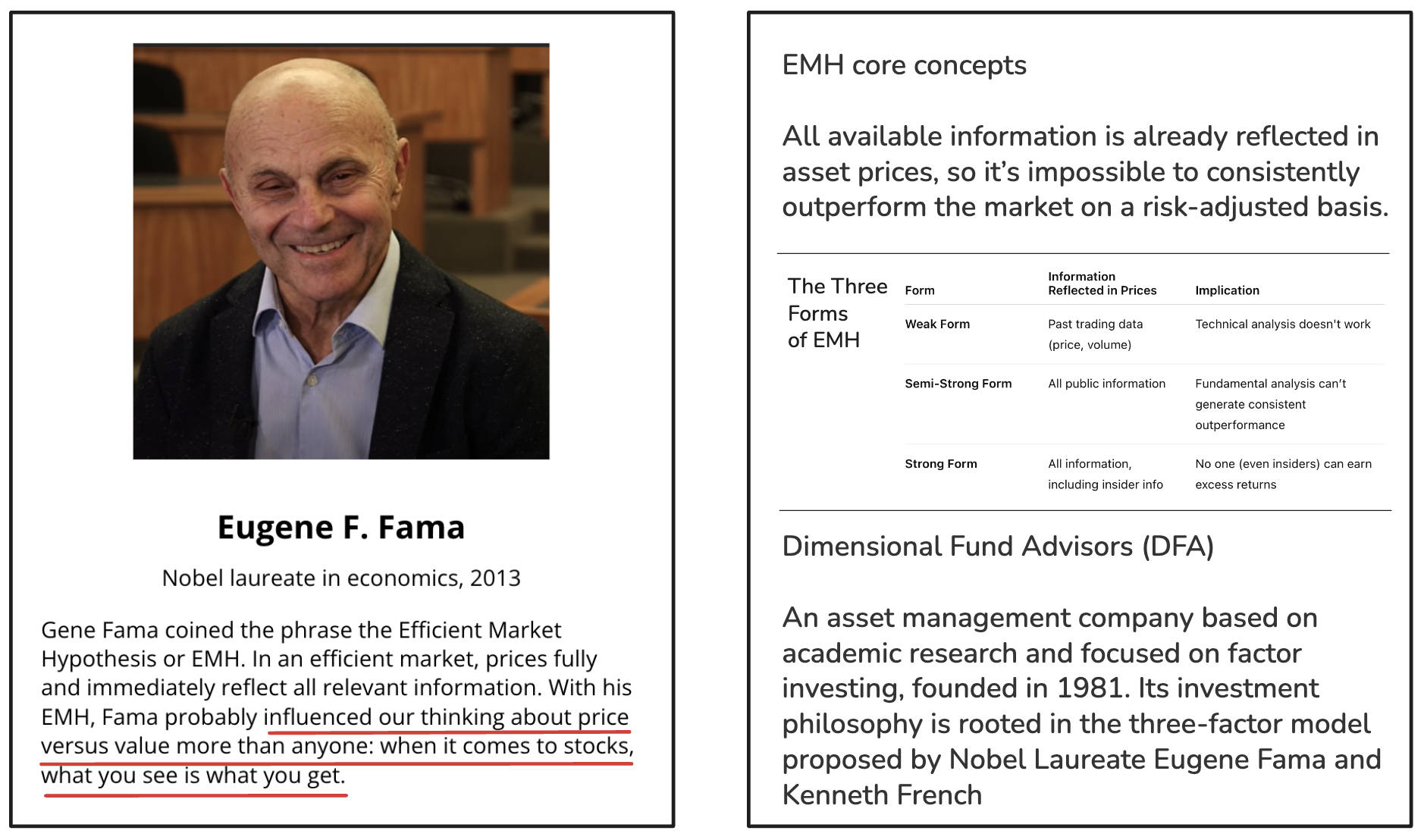

EMH - Efficient Market Hypothesis

Eugene Fama proposed the Efficient Market Hypothesis (EMH) in the 1970s. His research also inspired the academic investment firm Dimensional Fund Advisors (DFA), which is based on EMH and the factor investing work of Eugene Fama and Kenneth French.

❝ I don’t think there is a Perfect Portfolio. I think, at least, in my current view of the world, you have a multidimensional surface that’s characterized by a continuum of portfolios with different sorts of tilts, and the market portfolio is the center of that universe.

In aggregate, people have to hold the market portfolio. That’s it, and that’s an efficient portfolio in any model you want to think of.

And then you can decide to tilt away from that, towards other dimensions that we think capture different kinds of risk, and that’s personal decision. - Diversification is your buddy. If you decide to tilt away, you want to do it in the most diversified way you can. ——Eugene Fama ❞

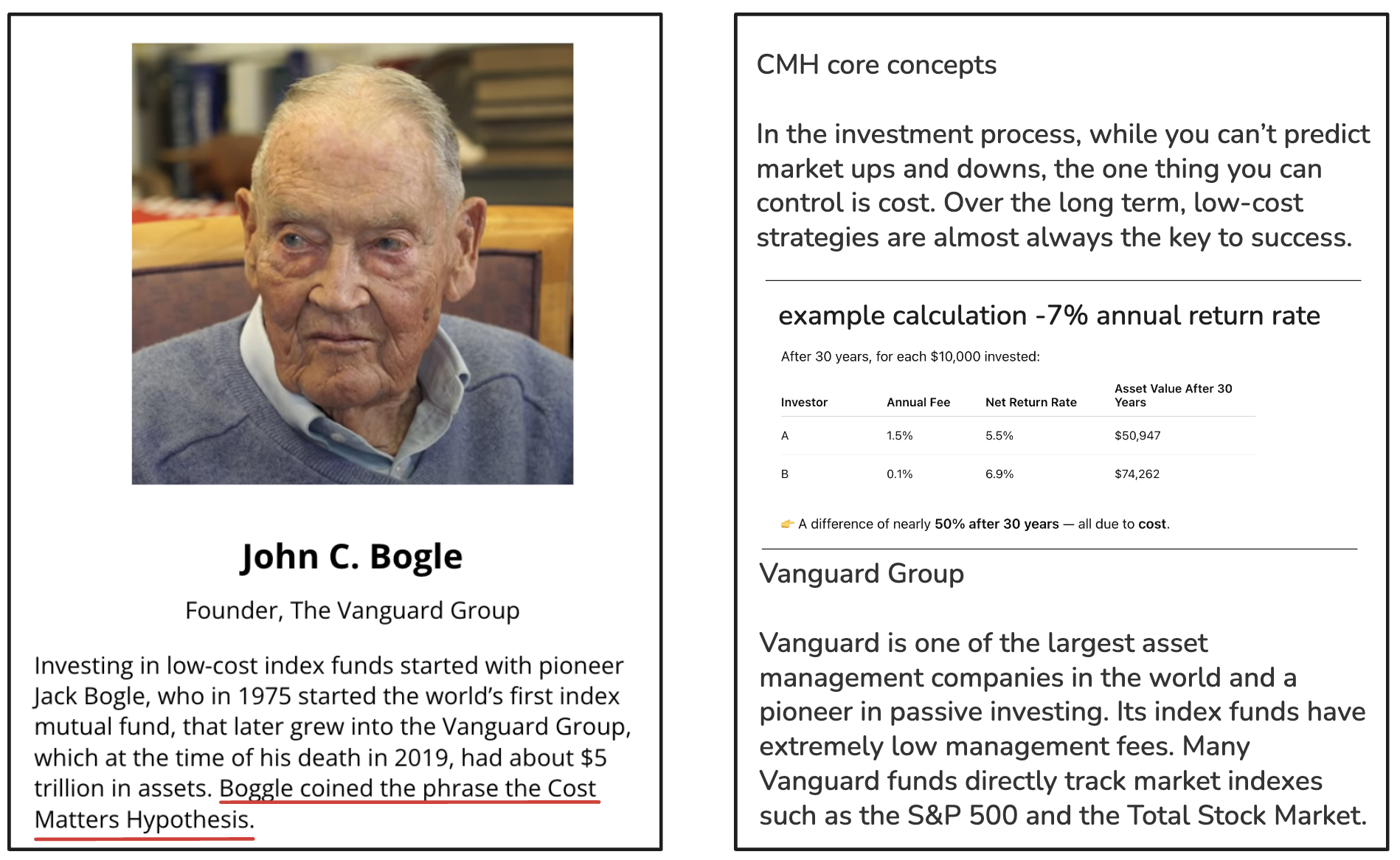

CMH - Cost Matters

John Bogle introduced the Cost Matters Hypothesis (CMH) in the 1970s and founded Vanguard, the iconic index fund company.

❝ I’ve concluded that regular rebalancing is not terrible, but not necessary. I’ve come to conclude that a 60/40 portfolio is probably the best option, rather than going from 80/20 to 20/80 in a target retirement plan. Although, I spend half my time worrying if I have too much in stocks and the other half of my time worrying that I have too little in stocks.

The secret to investing is that there is no secret. There is only the majesty of simplicity. When you own the entire stock market through a broad stock index fund, all the while balancing your portfolio with an allocation to an all-bond-market index fund, you create the optimal investment strategy. Owning index funds, with their cost-efficiency, tax-efficiency and their assurance that you will earn your fair share of the markets’ returns, is, by definition, a winning strategy.

Stay the course! ——John Boyle ❞

These theories also underpin the logic behind my own investment portfolio:

👉🏻 CPF and Balanced Portfolio Low-risk (almost risk-free) and a great bond alternative. The CPF system fits well into MPT-based stock-bond allocation calculations.

👉🏻 REITs and STI With a Sharpe Ratio of less than 1, they offer moderate risk-adjusted returns—not ideal for a high allocation.

👉🏻 Dimensional Funds Best practices based on the Efficient Market Hypothesis (EMH).

👉🏻 Vanguard Funds Best practices in line with the Cost Matters Hypothesis (CMH).

👉🏻 Low-Cost Broad-Based Index ETFs Low-cost exposure to relatively efficient markets. Among brokers available to Singapore investors, IBKR (Interactive Brokers) offers the most cost-effective access—such as investing in Ireland-domiciled ETFs listed on the LSE. A strategy aligned with both EMH and CMH.

The later chapters of the book delve into more complex financial concepts like options pricing models, financial derivatives, and market irrational exuberance. But I firmly believe that simplicity is the ultimate sophistication. The personal portfolio advice of these four financial titans consistently echoes the most fundamental investment principles: stay invested, diversify, keep costs low, invest for the long term.

Read More

How is the Singapore Public Health Care Subsidies Calculated

Understanding Singapore's healthcare subsidy system: how PCHI determines your subsidy rate and recent policy updates expanding coverage.

My Approach to Family Insurance Planning

It's the time of the year that the annual renewal of some of my family insurance policies is needed. While organizing my family's insurance policies, I thought that since I've discussed various insurance topics, why not share my family's insurance principles and strategies directly. Here I am sharing how I plan my family's insurance, with some useful