🙅🏻♀️ Being overly conservative in investment

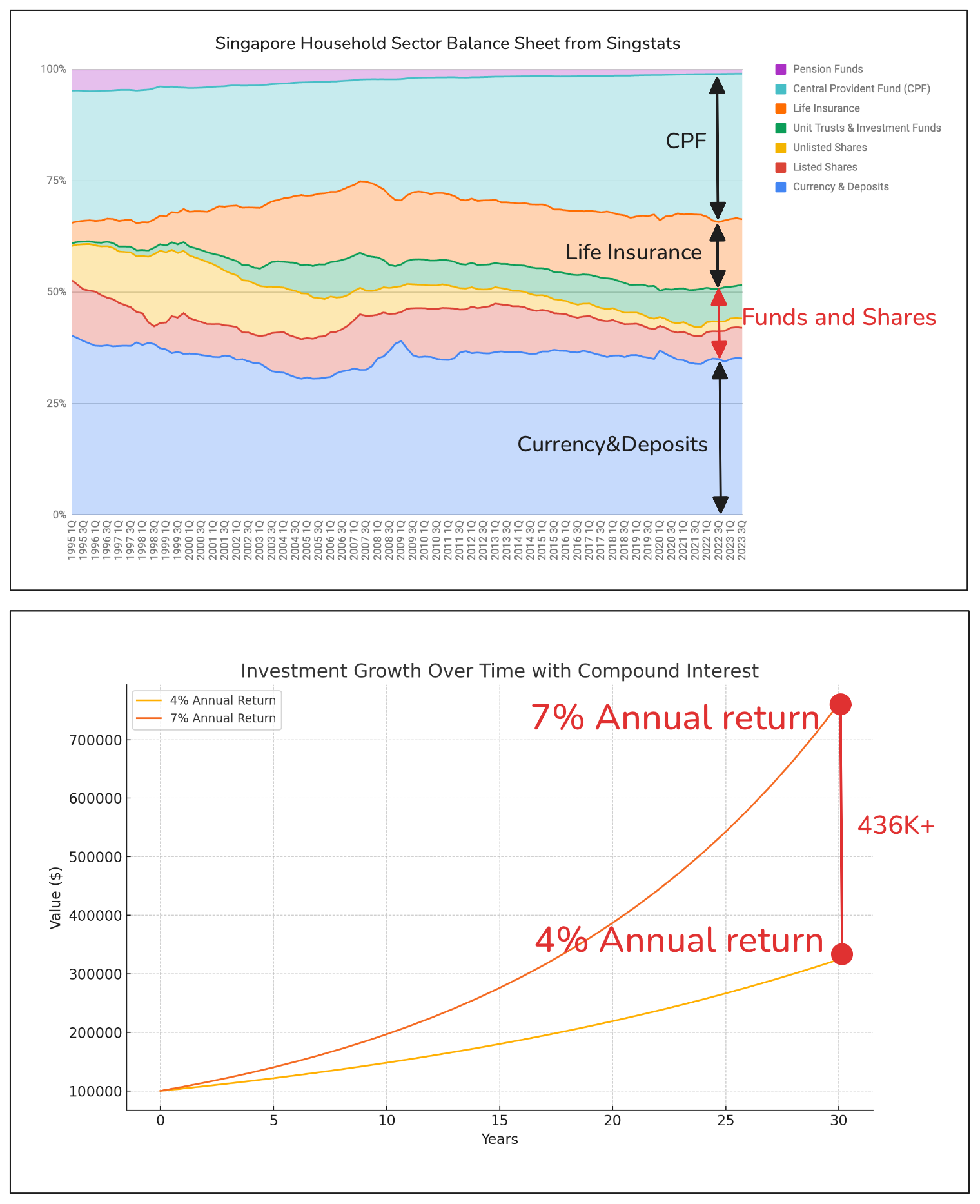

As I’ve shared previously in discussions on family financial planning and net worth calculation, many Singaporean households tend to adopt a conservative approach to investing. A large proportion of financial assets are held in cash savings and CPF accounts, while life insurance takes up a major share of investment-type financial assets.

While this conservative approach may feel safe, it offers limited help in growing wealth or keeping pace with inflation. For long-term financial goals, it’s often necessary — and reasonable — to accept some degree of market fluctuation in exchange for better returns.

🙅🏻♀️ Having a single investment channel

Having a single investment channel

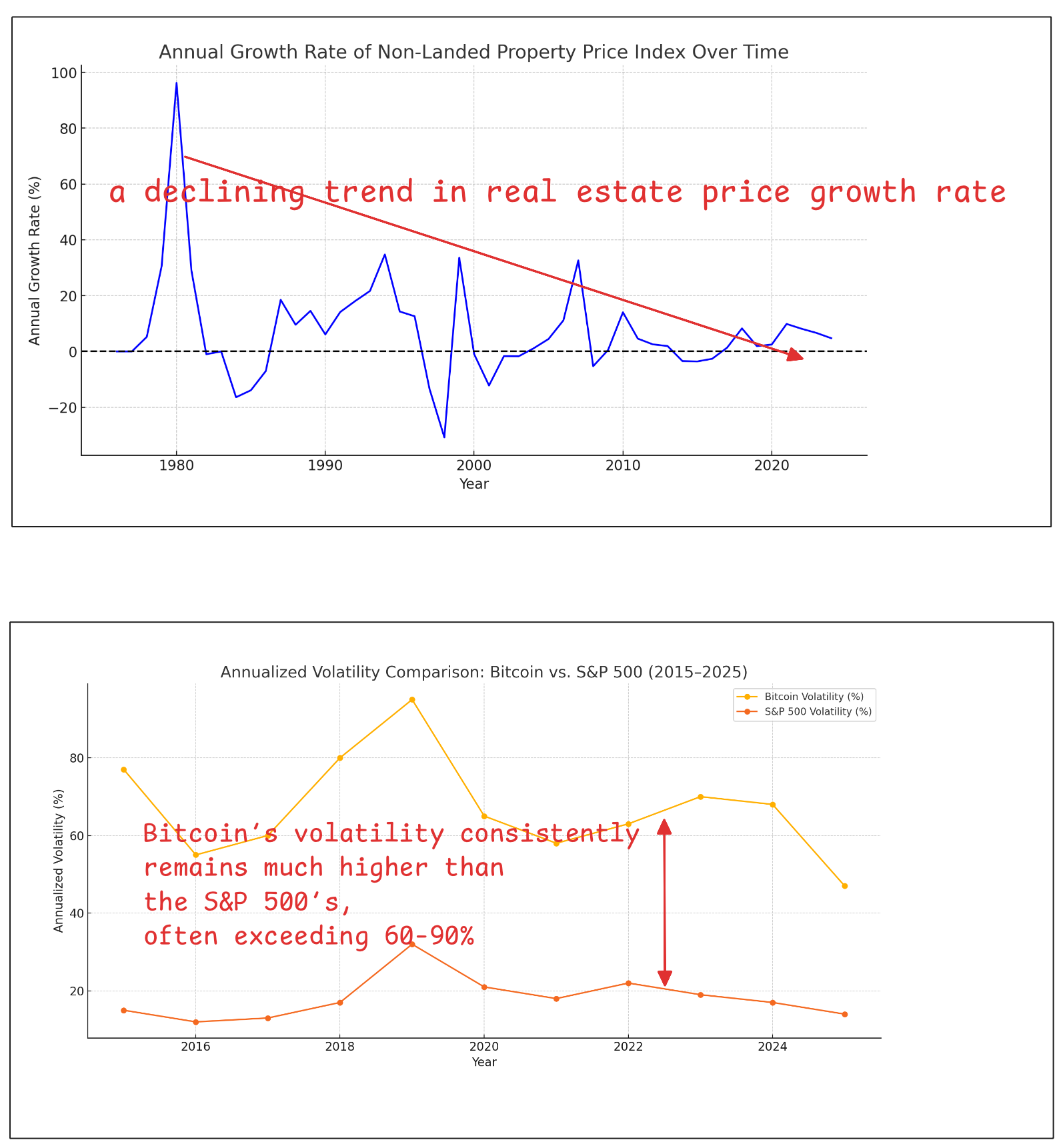

Real estate has long been a popular investment choice among Chinese families. Singapore itself has seen periods of rapid property price growth, reinforcing the belief that property can serve as a reliable retirement asset. And while property indeed holds value as an inflation-hedging asset, the environment today has become more challenging under tightened government regulations:

- 🚨 Property prices have risen, loan limits have tightened, and larger capital outlays are required

- 🚨 Concentrating wealth in a single property carries higher risks and substantial maintenance costs

At the other extreme, cryptocurrencies may offer eye-catching returns, but their risks far exceed those of most traditional investments. A healthier and more sustainable approach is to build multiple investment channels and maintain a diversified portfolio.

🙅🏻♀️ Over-focusing on “passive income” during wealth accumulation

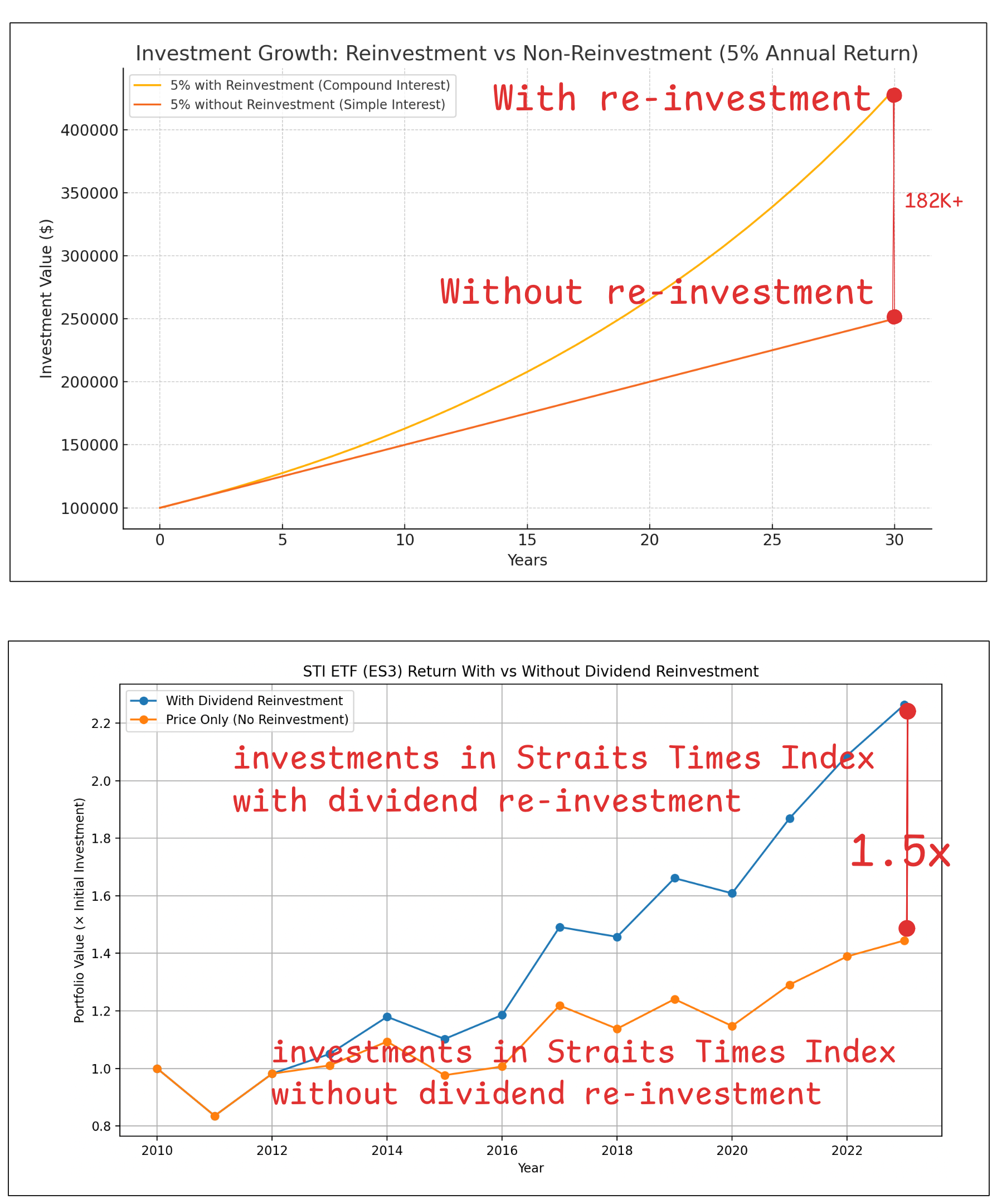

Growth-oriented stock indices like the S&P 500 and Nasdaq are highly volatile and generally pay low dividends, making it difficult to measure so-called “passive income.” Even for high-dividend investments, it’s important not to over-emphasize income generation too early.

The idea of “passive income” may lead to a false sense that this return can be freely spent like regular income. In reality, reinvesting dividends is crucial — it’s the foundation of compounding, which is the true engine of long-term wealth accumulation.

During this phase, it’s far more important to focus on savings rate, return on investment, and volatility — these factors should drive your asset allocation strategy.

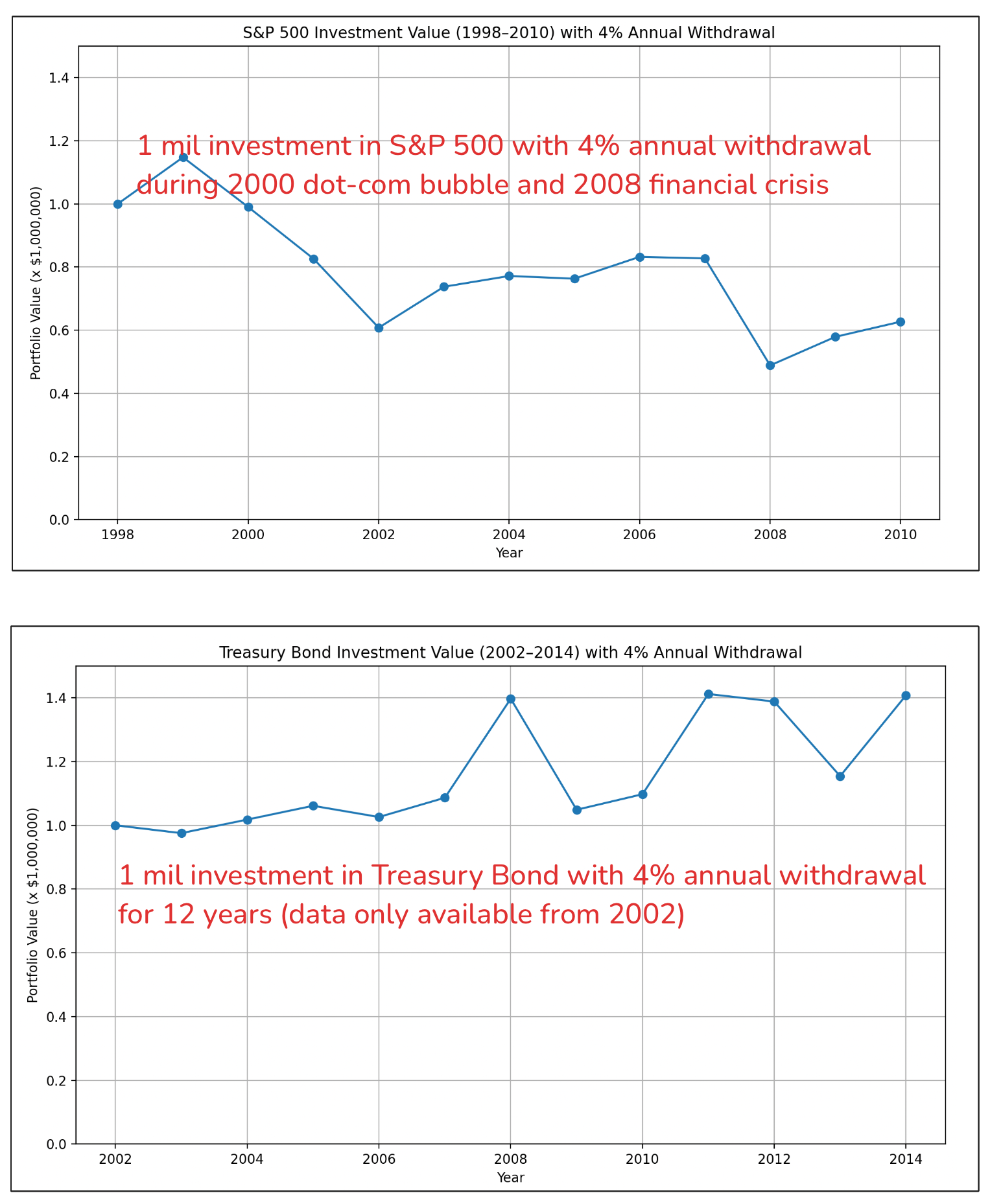

🙅🏻♀️ Over-focusing on “asset growth” during retirement

On the flip side, as one transitions from wealth accumulation to drawing on passive income in retirement, the priority should shift toward income stability and sustainability. A common misconception at this stage is continuing to chase asset growth, even when steady cash flow becomes more valuable.

I’ve previously touched on this when discussing retirement income planning and CPF LIFE: sacrificing some growth potential to secure a stable stream of income is often a wise trade-off to help manage longevity risk.

🙅🏻♀️ Over-relying on financial advisors

Putting aside how many truly competent and trustworthy advisors exist, I often ask myself:

“How long will this person be able to serve me? When I’m in my seventies or eighties and need help with medical insurance claims, retirement income optimization, or estate planning, will they still be there to provide quality advice?”

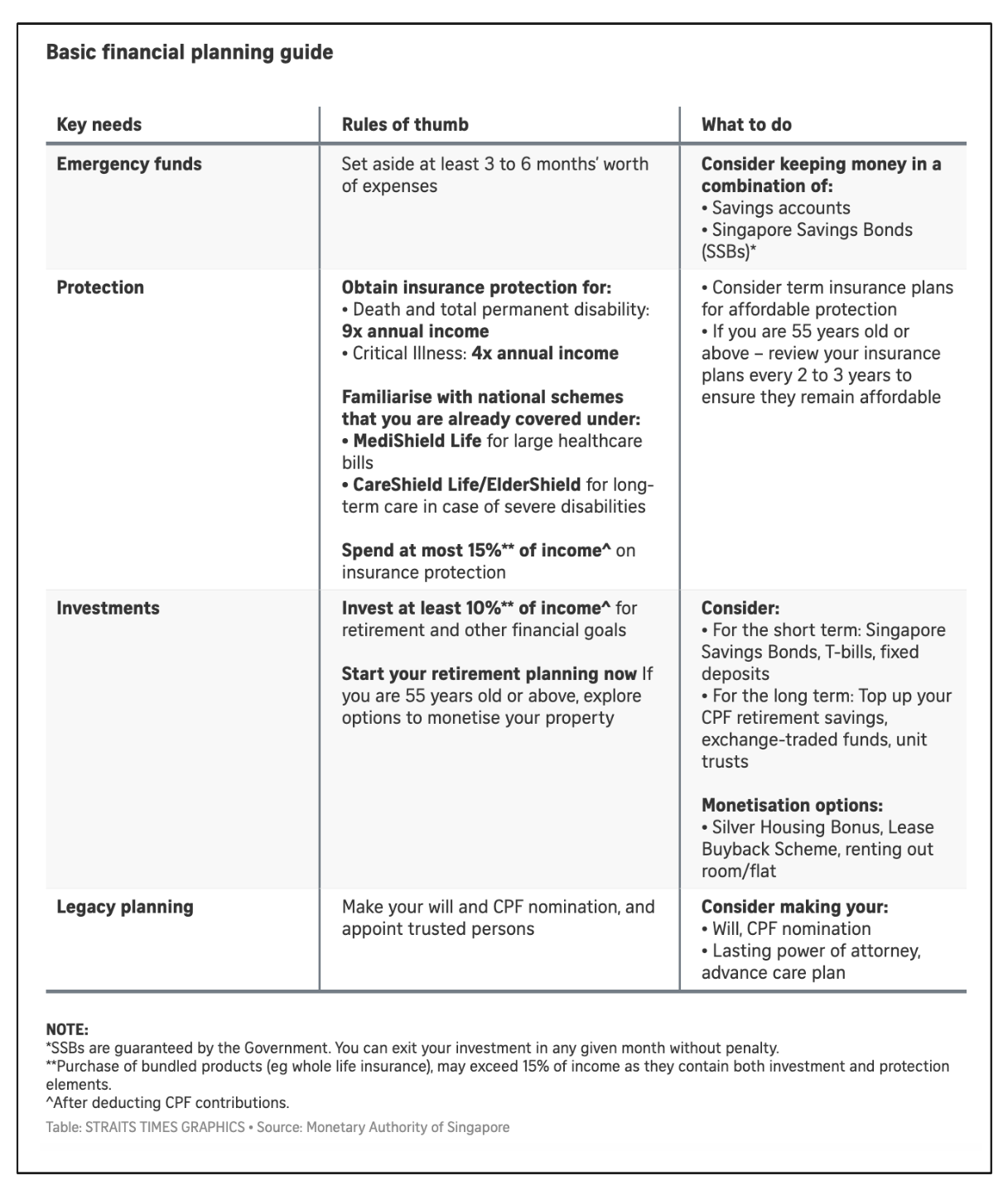

There’s rarely a clear answer. Without a basic foundation in personal finance, it becomes difficult to assess the quality of advice one receives. That’s why building financial literacy — in savings, insurance, investing, retirement planning, and estate planning — is essential to making sound decisions and taking responsibility for one’s financial future.

Read More

Be Cautious with Persuaders in Your Wealth Management Journey

Inspired by Howard Marks's famous book The Most Important Things, I am sharing some thoughts about brokerages, fund firms, insurance companies and banks and how to navigate through the different service providers wisely.

Profoundly Simple Investment Strategies

Key investment theories from four finance legends: Markowitz's MPT, Sharpe's CAPM, Fama's EMH, and Bogle's CMH—and how they shape my portfolio.