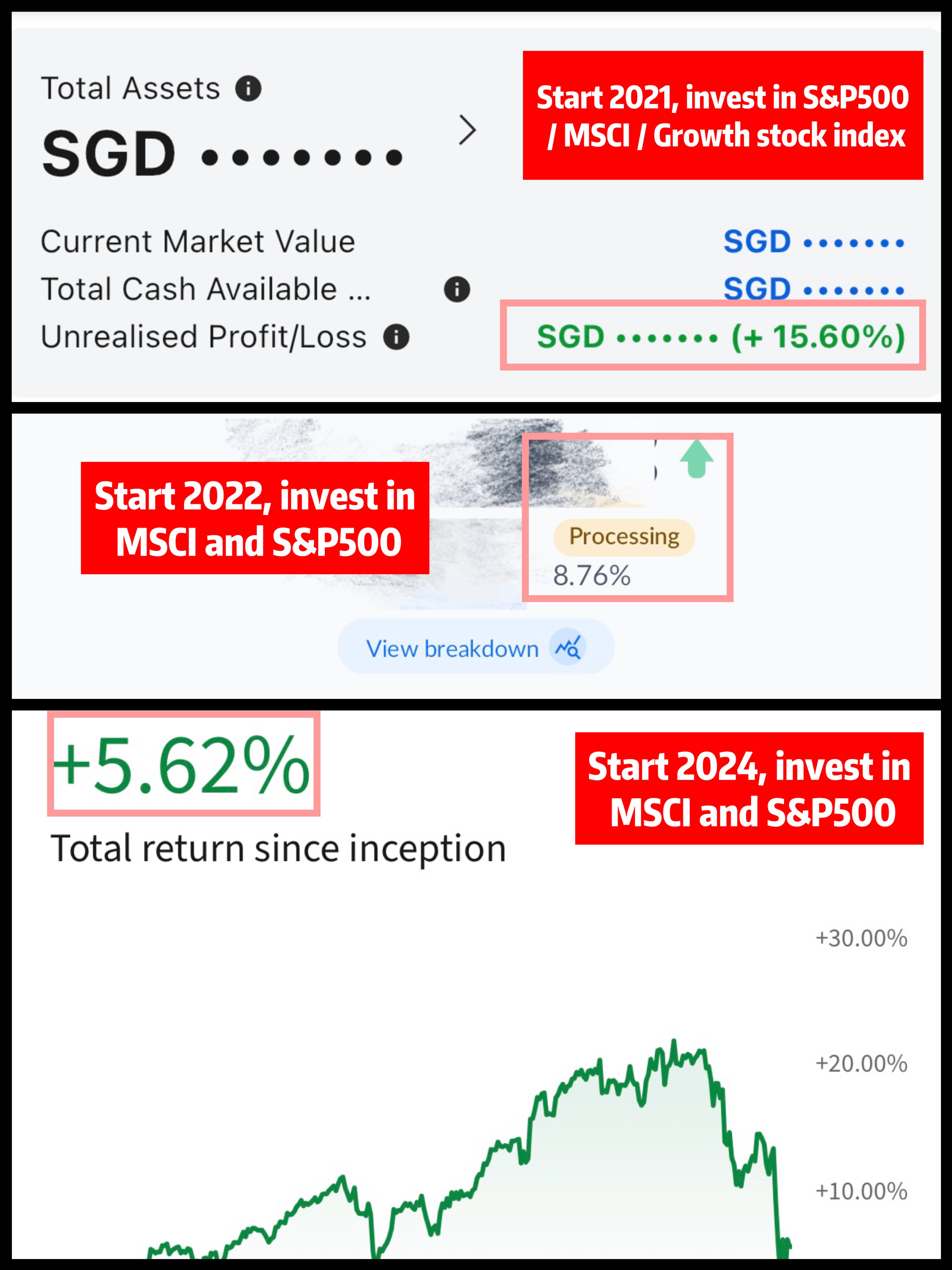

How much has a few years of passive DCA (dollar-cost averaging) investment been impacted during the recent stock market volatility triggered by Trump’s tariff policies?

This screenshot was taken in April 2025 during the market dip, close to the recent low point. Although there was a significant drawdown, my investment returns had not turned negative. The various portfolios I maintain are quite similar in their underlying holdings — mainly S&P 500 and MSCI index funds or ETFs. I manage multiple accounts due to differences in platform fees, product offerings, and funding sources (cash or SRS accounts). I’ve previously shared some notes on choosing brokers: FSMOne, Endowus, and IBKR.

By sticking to my monthly DCA strategy, I was able to average down during the full-year decline in 2022. The rebound in late 2023 and into 2024 provided decent growth, so even with some recent pullbacks, my portfolio still maintains positive gains.

Of course, future market trends are unpredictable. Historical data shows that drawdowns of up to 40 percent have happened before. Still, staying committed to broad-based index fund DCA remains my long-term strategy, even in volatile markets.

Recently, I’ve been reflecting further: with the Singapore dollar performing strongly and the economy remaining stable, I’m considering increasing my allocation to REITs and local blue-chip stocks.

Read More

Wealth Management for Ordinary Income Earning Family

In this post, I am sharing our ways to do family wealth management as an ordinary income earning family, bascially answering the following three questions: how much assets do we have? how much do we earn, spend and save? and what are our life goals?

The Darkside of the Medical Concierge Service in Singapore

A critical look at medical concierge services: conflicts of interest when concierges earn commissions from clinics while claiming to serve patient needs.