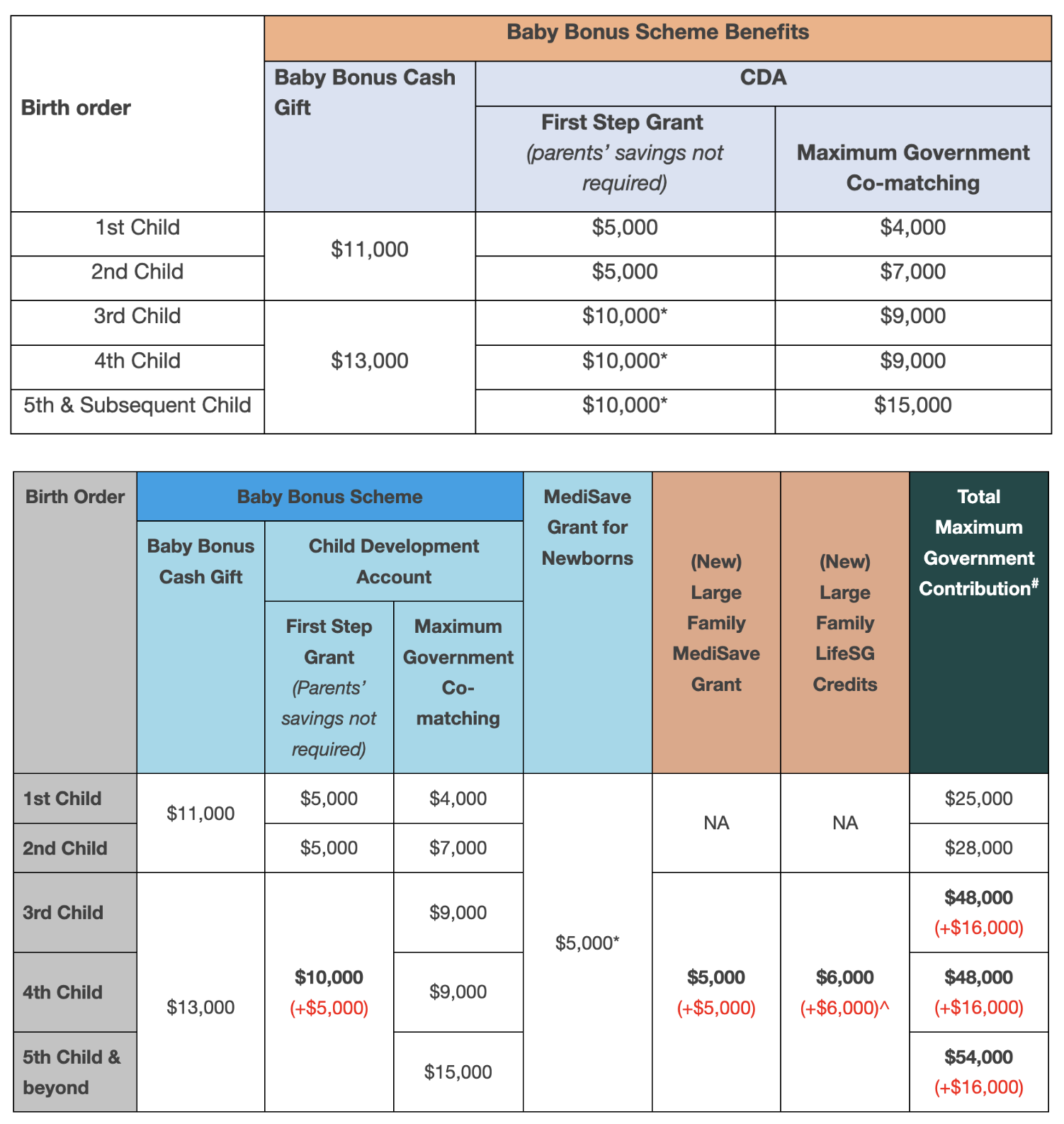

💰 Cash Benefits (Baby Bonus)

- 1st Child: $20,000 ($11,000 + $9,000)

- 2nd Child: $23,000 ($11,000 + $12,000)

- 3rd/4th Child: $38,000 ($13,000 + $19,000 + $6,000)

- 5th Child & Beyond: $44,000 ($13,000 + $25,000 + $6,000)

Families with three or more children receive an additional $1,000 top-up via LifeSG each year, up to $6,000 total (until the child turns 6).

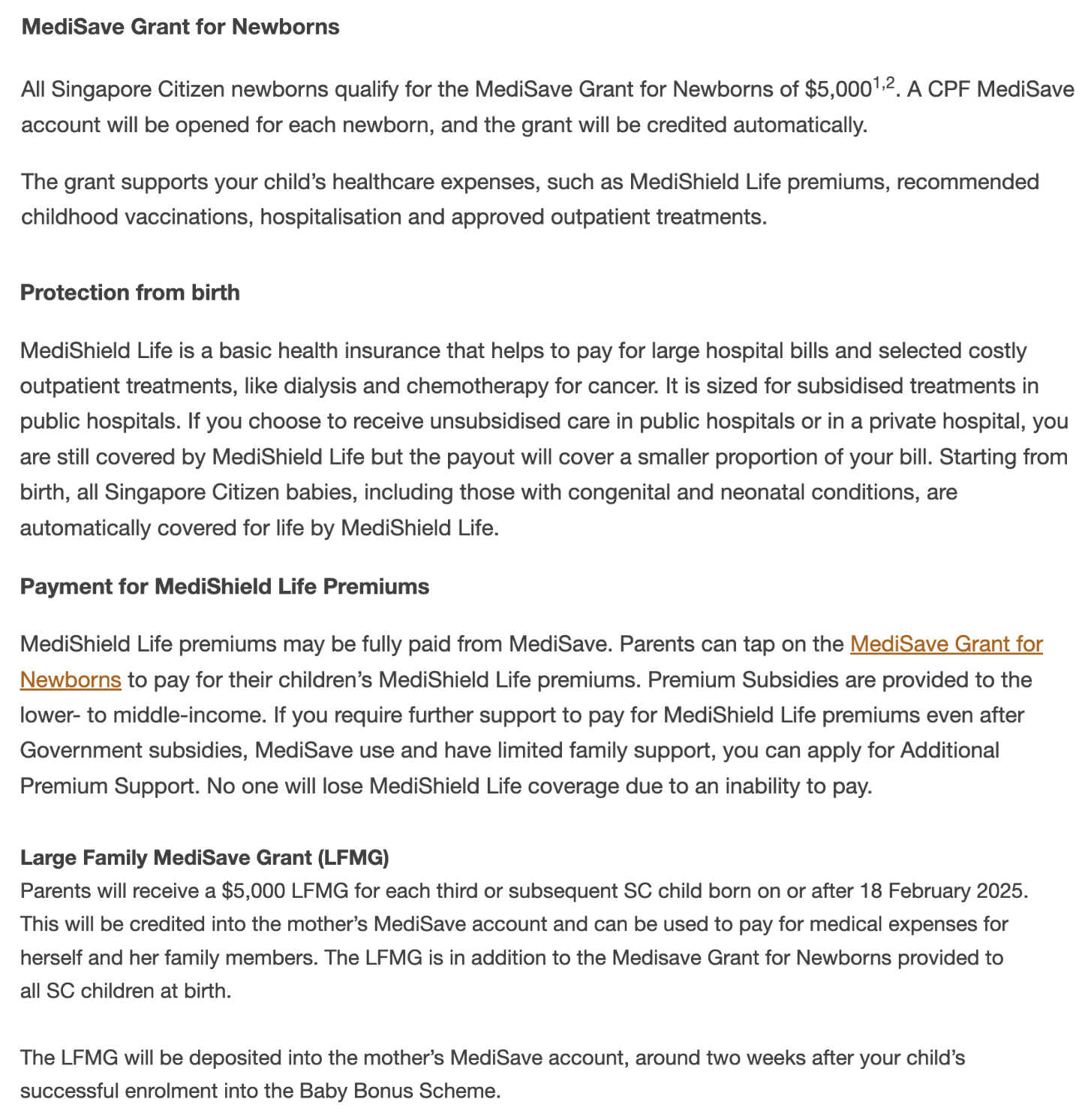

🏥 MediSave Grant & Grant & Health Coverage (MediShield Life)

- CPF MA Top-up: $5,000–$10,000 (can be used for MediShield premiums, vaccinations, outpatient visits, and hospitalisation)

- MediShield Life Insurance: Provides lifelong hospitalisation coverage from birth, including congenital and neonatal conditions, based on subsidised public hospital treatment rates.

Families with three or more children also receive an extra $5,000 MediSave grant (credited to the mother’s CPF MA).

🚼 Vaccinations & Developmental Screenings

- Vaccination Subsidies: Children eligible for nationally recommended vaccinations receive up to 100% subsidy at polyclinics or CHAS-participating GP clinics.

- Developmental Screenings: Eligible Singapore Citizen (SC) and Permanent Resident (PR) children can receive full or partial subsidies for seven key developmental screenings.

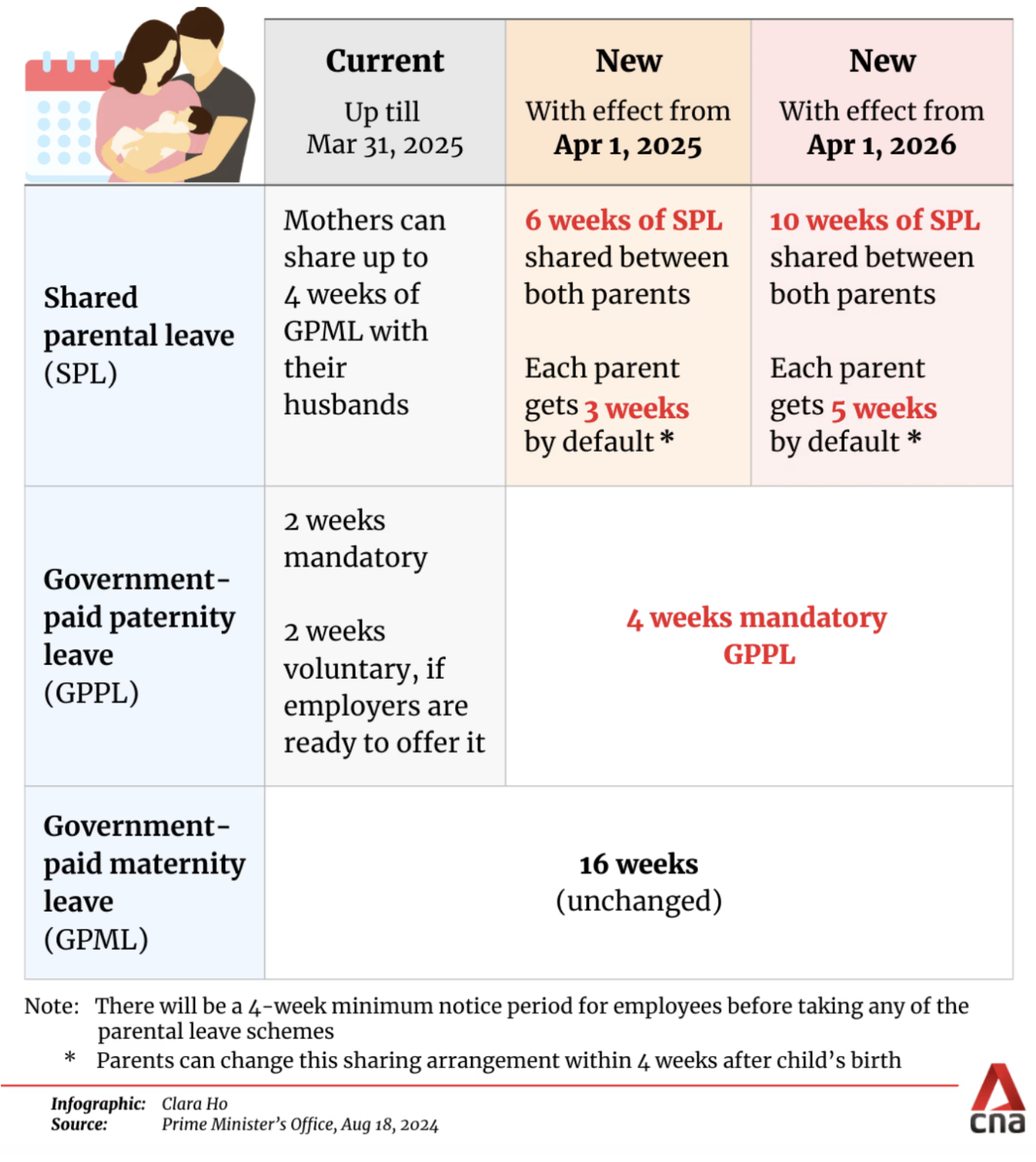

🍼 Maternity & Paternity Leave Reimbursements

- Maternity Leave: 16 weeks paid leave, with 8 weeks (or full 16 weeks for 3rd child and beyond) reimbursed by the government (up to $2,500/week)

- Paternity Leave: 4 weeks paid leave fully reimbursed by the government (up to $2,500/week)

- Shared Parental Leave: Up to 6 weeks reimbursed by the government (to increase to 10 weeks from April 2026, up to $2,500/week)

Employers are not required to pay beyond the $2,500/week reimbursement cap, but may choose to top up voluntarily.

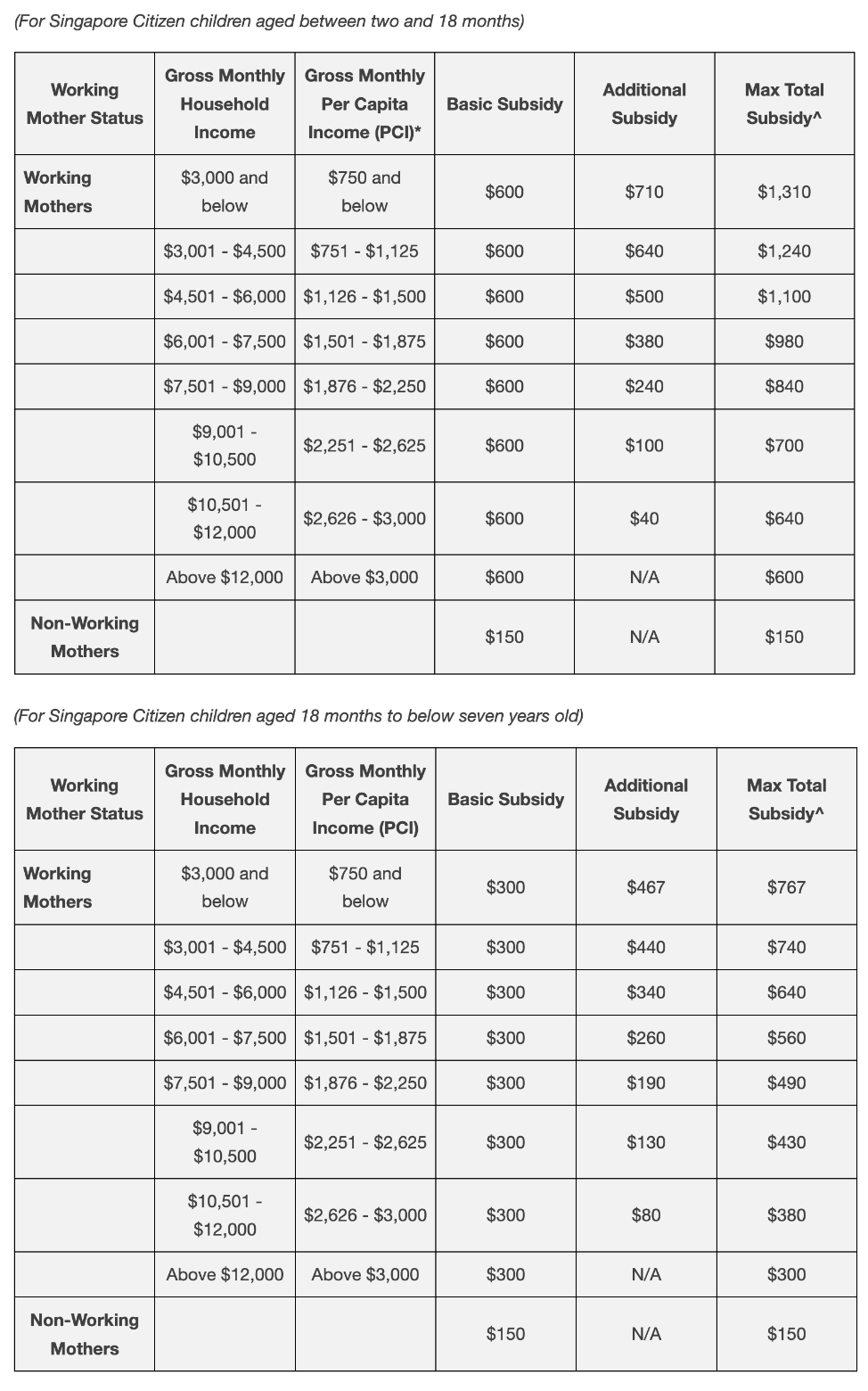

🏫 Preschool Subsidies

- Infant Care (2–18 months): Subsidies from $600 to $1,310/month

- Childcare (18 months–6 years): Subsidies from $300 to $767/month

Available to working mothers, based on household income.

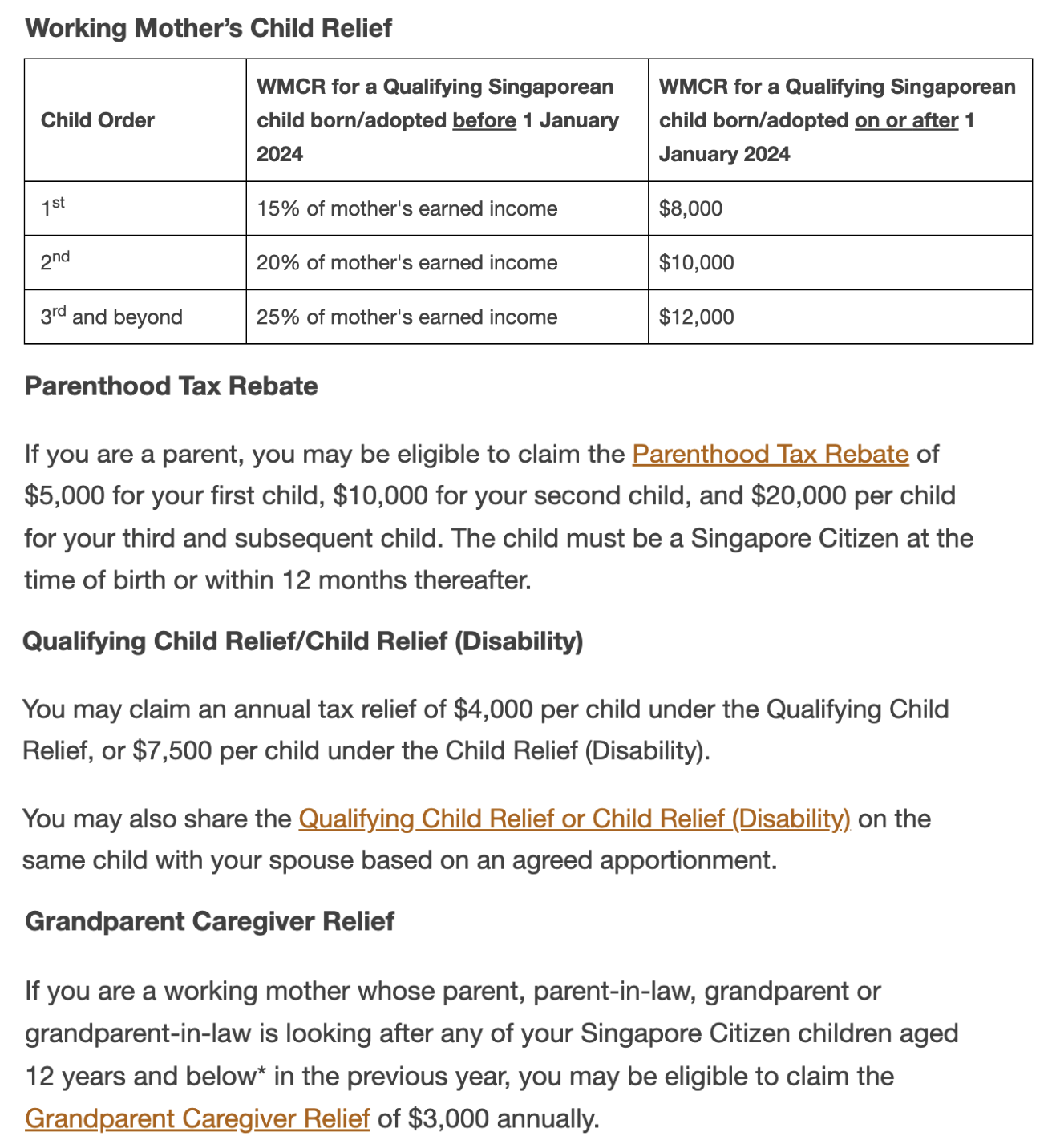

📑 Personal Income Tax Reliefs

- Working Mother’s Child Relief (WMCR): $8,000/$10,000/$12,000 annually for the 1st/2nd/3rd+ child

- Parenthood Tax Rebate (PTR): $5,000/$10,000/$20,000 (one-time, per child tier)

- Qualifying Child Relief (QCR): $4,000/year

- Grandparent Caregiver Relief: $3,000/year

Based on an income tax rate of 11.5% (for annual income $80K–$120K), the first year’s tax savings could range from $2,300 to $4,485.

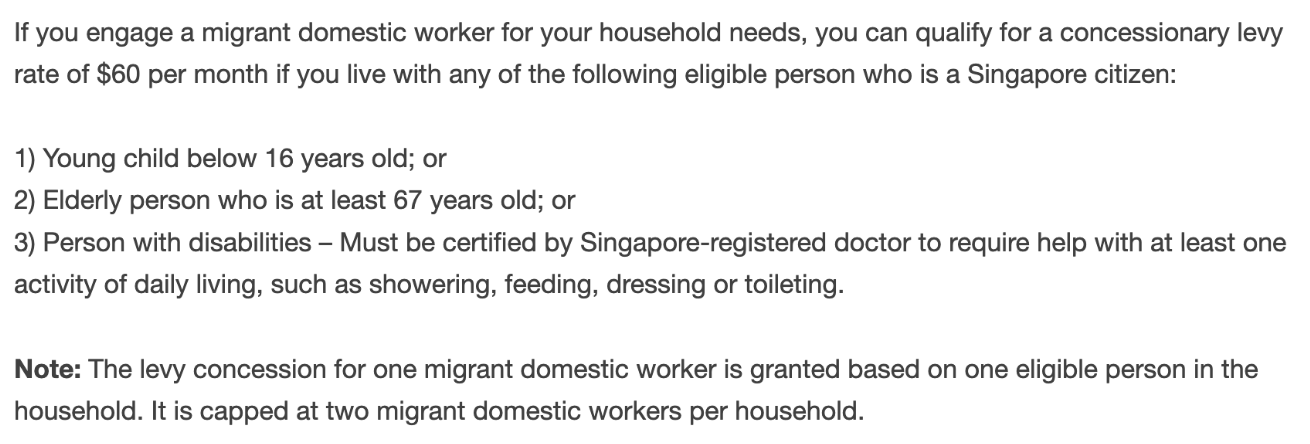

🧹 Foreign Domestic Worker Levy Concession

Levy Reduced from $300/month to $60/month

For families with at least one child under 16 years old.

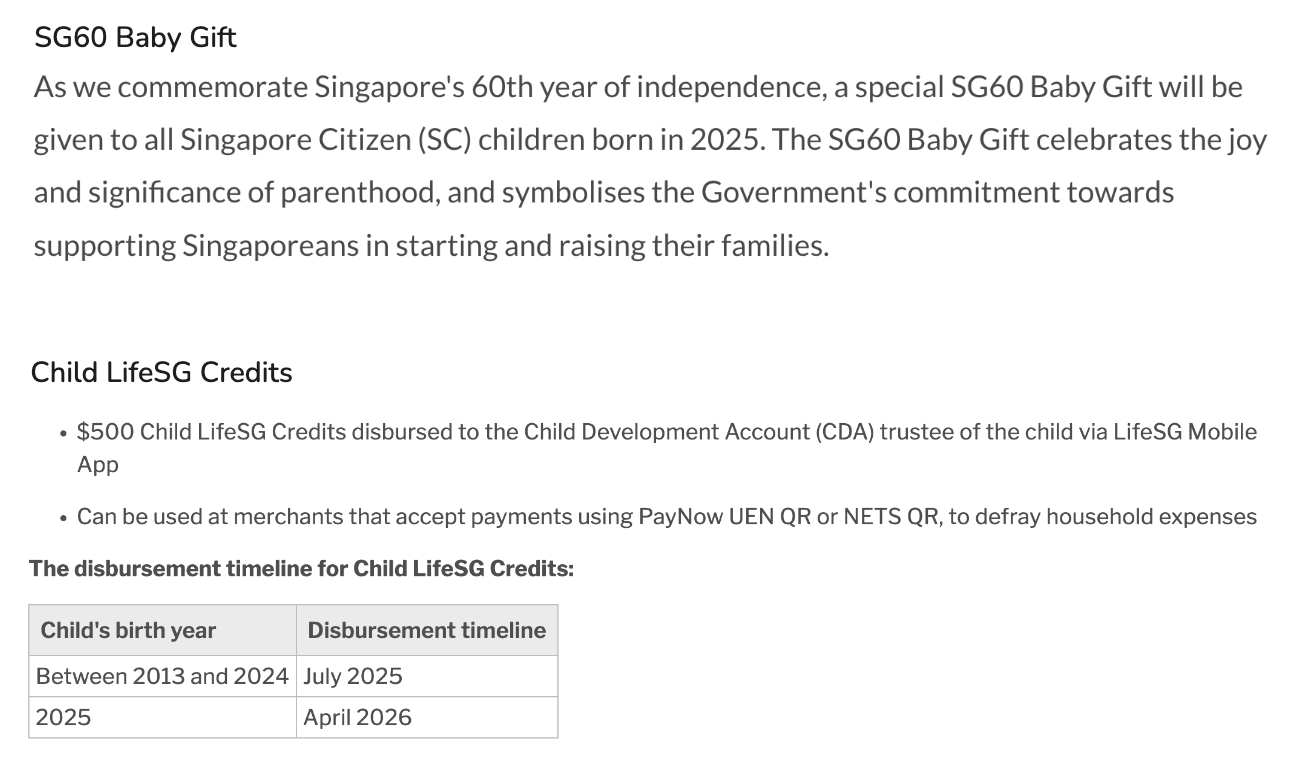

🇸🇬 Small Perks from SG60 & LifeSG

- SG60 Baby Gift: Special gift fo SG60 babies!

- LifeSG Parenthood Support Grant: $500 (available for babies born in 2025, to be disbursed in 2026)

🙋🏻 Can Government Benefits Cover Basic Healthcare and Preschool Costs?

Assuming parents opt for public institutions and qualify for means-tested subsidies:

🏥 Basic Hospitalisation Insurance

- Public A Ward IP Plan: ~$2,100 over 7 years (assuming $300/year premium, fully payable via CPF)

✅ Covered by MediSave top-ups

👩🏼🍼 Basic Infant and Childcare Costs

- Infant Care (5–18 months): $560–$10,444 total (after subsidy, $40–$746/month for 14 months)

- Childcare (Preschool to K2): $162–$21,438 total (after subsidy, $3–$397/month over 4.5 years)

Total Estimated Cost: $722 – $31,882

✅ For families with 3 or more children, Baby Bonus may fully cover these costs. For 1st or 2nd child, benefits can cover all or part of the costs depending on household income.

Read More

How is the Singapore Public Health Care Subsidies Calculated

Understanding Singapore's healthcare subsidy system: how PCHI determines your subsidy rate and recent policy updates expanding coverage.

Common Investment Misconceptions

Four common investment mistakes: being overly conservative, single investment channels, over-focusing on passive income early, and chasing growth in retirement.