My Medical and Critical Illness Insurance

Let me share my medical and critical illness insurance setup (I shared how I plan for my family’s insurances here). It might be a bit over-insured, but that’s largely due to my personal experiences and risk preferences. First, here’s how I see the roles of life and critical illness insurance:

What does life insurance cover?

- Primary purpose: Death benefit (financial responsibility after death)

- Secondary purpose: Wealth transfer

What does critical illness (CI) insurance cover?

- Primary purpose: Income replacement

- Secondary purpose: Medical expense supplement

The reason for dividing the purposes this way is:

For most families without complex estate planning needs, whole life insurance offers low returns and high costs — it’s not an optimal wealth accumulation tool. If you buy it, it’s often more symbolic than practical.

A comprehensive hospitalization plan provides much better coverage for medical expenses than a one-time CI payout. CI payouts typically only cover a small portion of expenses not already covered by medical insurance.

My current setup for medical and CI insurance includes:

- 🏥 Company group outpatient insurance

- 🏥 Company group hospitalization insurance

- 👩🏻💻 Company group late-stage CI insurance

- 🏥 Personal Integrated Shield Plan (IP) with rider

- 👩🏻💻 Term life with late-stage CI rider (up to age 60)

- 👩🏻💻 Term CI plan with early-stage and multiple payout features (up to age 70)

- 🩻 Term early-stage cancer plan (up to age 85)

Why hold multiple term CI plans for different durations?

Because the primary purpose of CI insurance is income replacement. Based on my retirement timeline, as passive income increases and active income becomes less essential, I can flexibly cancel policies accordingly.

Why purchase a standalone cancer plan?

Because of family medical history and because among the “big three” critical illnesses, cancer has the highest incidence, the highest mortality, and the greatest uncertainty in treatment cost. Extra coverage may help offset these additional medical expenses.

Why not opt for lifetime CI coverage?

Because income replacement isn’t a lifelong need. Even with cancer, disease progression tends to slow with age. Medical coverage provides the main financial support, and with sufficient accumulated wealth later in life, lump-sum payouts become more of a bonus than a necessity.

What are the Elderly’s Need in Insurance and Wealth Management?

This leads me to a broader question: What kind of insurance and financial tools do elderly truly need? Which types of coverage should actually last a lifetime?

Based on my current understanding and plans, here’s what seniors need:

- 🧑⚕️ Lifetime long-term care insurance (e.g., upgraded CareShield Life)

- 🏥 Adequate medical coverage (MediShield Life, IP with rider)

- 💵 Lifelong passive income (CPF Life, annuity plans, rental and dividend income)

- 💰 Solid savings: for cash flow, emergency medical reserves, and wealth transfer

A comprehensive IP hospital plan becomes extremely expensive in old age — but it’s also indispensable. It provides far better protection than CI payouts, especially for serious illnesses. That’s why we need sufficient passive income in later years to support its premiums.

Whole life insurance often offers fixed payment terms in exchange for lifetime coverage, which sounds convenient. But money has time value — the premiums you finish paying continue to grow in value. That growth is the real cost of lifetime protection.

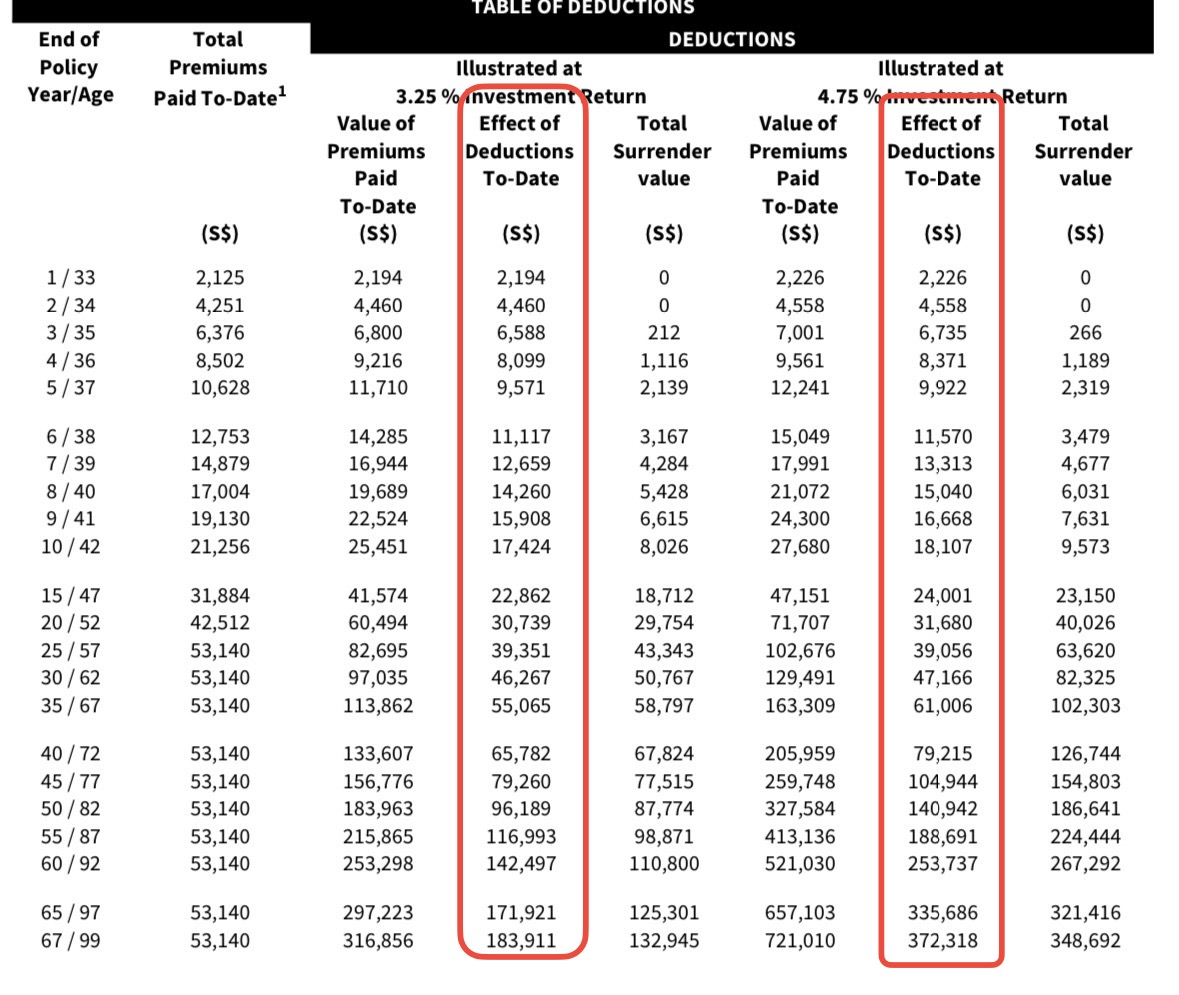

How much is that cost? You don’t need to calculate it yourself. It’s clearly listed in the insurance policy’s “Effect of Deductions To-Date” section of the Price Table — a disclosure mandated by MAS. If you check a typical whole life policy, you may be shocked to find how large this cost can be in later years.

The difference between the “Value of Premiums Paid To-Date” and “Total Surrender Value” represents the “Effect of Deductions To-Date”. This is the accumulated value of the deductions for the cost of insurance and expenses.

This amount, if saved or invested independently, could grow more efficiently — and it would be much more flexible to use. Another paradox: if you attach a CI rider to a whole life or investment-linked plan and later surrender the policy for its cash value, the so-called “lifetime CI coverage” disappears as well.

This explains why a whole life or ILP with a CI rider doesn’t meet my needs: the product is too complex, relatively expensive, and inflexible.

That’s why I believe: insurance is a necessary expense — it should be used to cover the risks I currently can’t afford. The majority of my income should go into disciplined savings and regular investment in a well balanced portfolio which takes my investment horizon, risk tolerance into consideration. Once I’ve accumulated enough for semi-retirement or full retirement, I can then consider annuities and legacy-focused insurance tools to meet retirement planning needs.

Read More

Investment Return during Market Downturn

Still, staying committed to broad-based index fund DCA remains my long-term strategy, even in volatile markets

Our Experience on Insurance Dispute Resolving in Singapore

This is a story about how we resolved an insurance dispute due to irresponsible agent and insurance company and protected our rights through FIDReC.