As an expecting mother, I was always wondering - should I buy maternity insurance? With the help of AI, I went though most of the maternity insurance policies available in the market, and decided not to purchase any. These are the reason:

🤰🏻 Bundled Maternity Insurance

Bundled maternity insurance refers to maternity coverage that is tied to life insurance or investment-linked policies:

| Plan | Base Plan Type | Maternity Coverage | Transfer to Baby | Key Benefits |

|---|---|---|---|---|

| A** | Whole Life (GPP IV) | Yes | Within 100 days | Pregnancy & congenital, NICU, ICU, phototherapy, lifelong CI riders, GIO for health insurance |

| A** | Investment-Linked (PLP II) | Yes | Within 100 days | Flexible fund growth, similar baby coverage, auto transfer + GIO for IP |

| P** | Whole Life (PAL III) | Yes | Within 60 days | 25 congenital illnesses, hospitalisation, PRUShield option, lifetime coverage with riders |

| H** | Whole Life or ILP | Yes | Within 60 days | 26 congenital illnesses, developmental delay, free 1st yr IP Plan B |

| H** | Whole Life or ILP (wider) | Yes | Within 60 days | Covers additional family, same prenatal features as HappyMummy |

Personally, I would not consider this type of product, as the premiums are very high, and I do not have any additional needs for life insurance or investment products. The concerns I have regarding maternity protection are quite similar to those I’ll explain below when discussing standalone term maternity insurance.

🤰🏻 Standalone Term Maternity Insurance

I took a closer look at standalone term maternity insurance plans that cover a 3- to 4-year period with a one-time premium payment:

| Plan | Premium (Est.) | Sum Assured | Pregnancy Complications | Baby Hospital Coverage (incl. NICU, Premature Birth) | Pre-existing Conditions Covered? |

|---|---|---|---|---|---|

| I** | ~S$730–S$800 | S$10,000 | 10 conditions | ICU/NICU, phototherapy, HFMD, pneumonia – up to 30 days | ❌ No |

| S** | ~S$1,200–S$1,300 | S$20,000 | 10 conditions | NICU, incubation, phototherapy – up to 30 days | ❌ No |

| P** | ~S$1,500–S$1,600 | S$20,000 | 17 conditions | 25 days, ICU ≥3 days, phototherapy | ❌ No |

| H** | ~S$1,400–S$1,500 | S$20,000 | 15 conditions | NICU, HFMD, developmental delay, 30 days max | ❌ No |

| G** | S$916 | S$10,000 | 18 conditions | ICU/HDU, phototherapy, HFMD, infection, etc., up to 30 days (S$200/day) | ✅ Yes – conditional via GIB |

After much consideration, I ultimately decided not to purchase one. The reasons are as follows:

❶ If the mother already has sufficient life and hospitalisation insurance, many of the major risks during pregnancy and delivery are already covered. Both of my corporate and personal hospitalisation insurance typically cover pregnancy-related medical expenses (e.g. gestational diabetes, breech C-sections, etc.), and my personal life insurance provides sufficient coverage as well. As such, maternity insurance doesn’t add much additional protection for me personally.

❷ Coverage for premature birth treatment and congenital conditions for the newborn is limited. The maximum benefit is usually capped at $20,000, similar to accident insurance. While it offers a small safety net, it doesn’t provide sufficient financial protection for major unexpected expenses:

- 🚫 High costs of treating complications from premature birth (which can exceed $100,000)

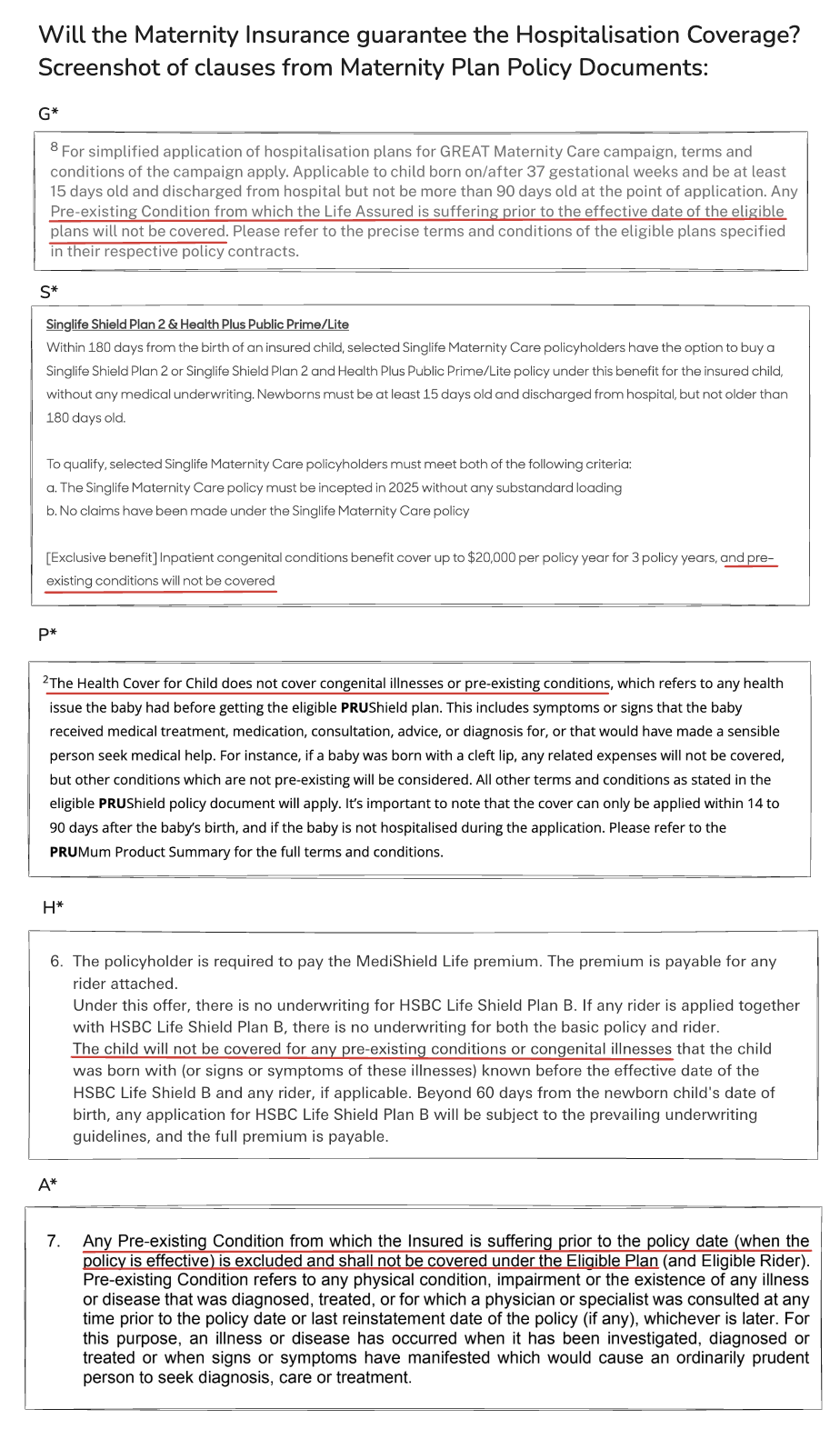

- 🚫 No guaranteed hospitalisation coverage for congenital conditions under Integrated Shield Plans (IP). Currently, no maternity plan guarantees newborn eligibility for IP coverage of congenital illnesses. Some policies allow enrollment but with exclusions (see Figure 4).

❸ Premiums for older expectant mothers are relatively high: over $1,000 in premiums for only $20,000 in coverage.

🤰🏻 Other Solutions

High-End International Health Insurance

Some high-end international health insurance plans cover prenatal care, delivery, and premature birth treatments. However, they come with high barriers: premiums are expensive, and there’s usually a waiting period (for example, only pregnancies that occur 10 months after enrollment are eligible for reimbursement — meaning you can’t purchase it after already becoming pregnant). These plans are generally designed for high-income families and are impractical for most households, especially if timed solely around pregnancy.

If your employer offers such insurance, it’s worth reviewing the details, especially regarding newborn coverage.

Affordable Public Healthcare Resources

The purpose of insurance is to transfer high-risk financial burdens, but not all risks are insurable — or may come with costs beyond one’s means.

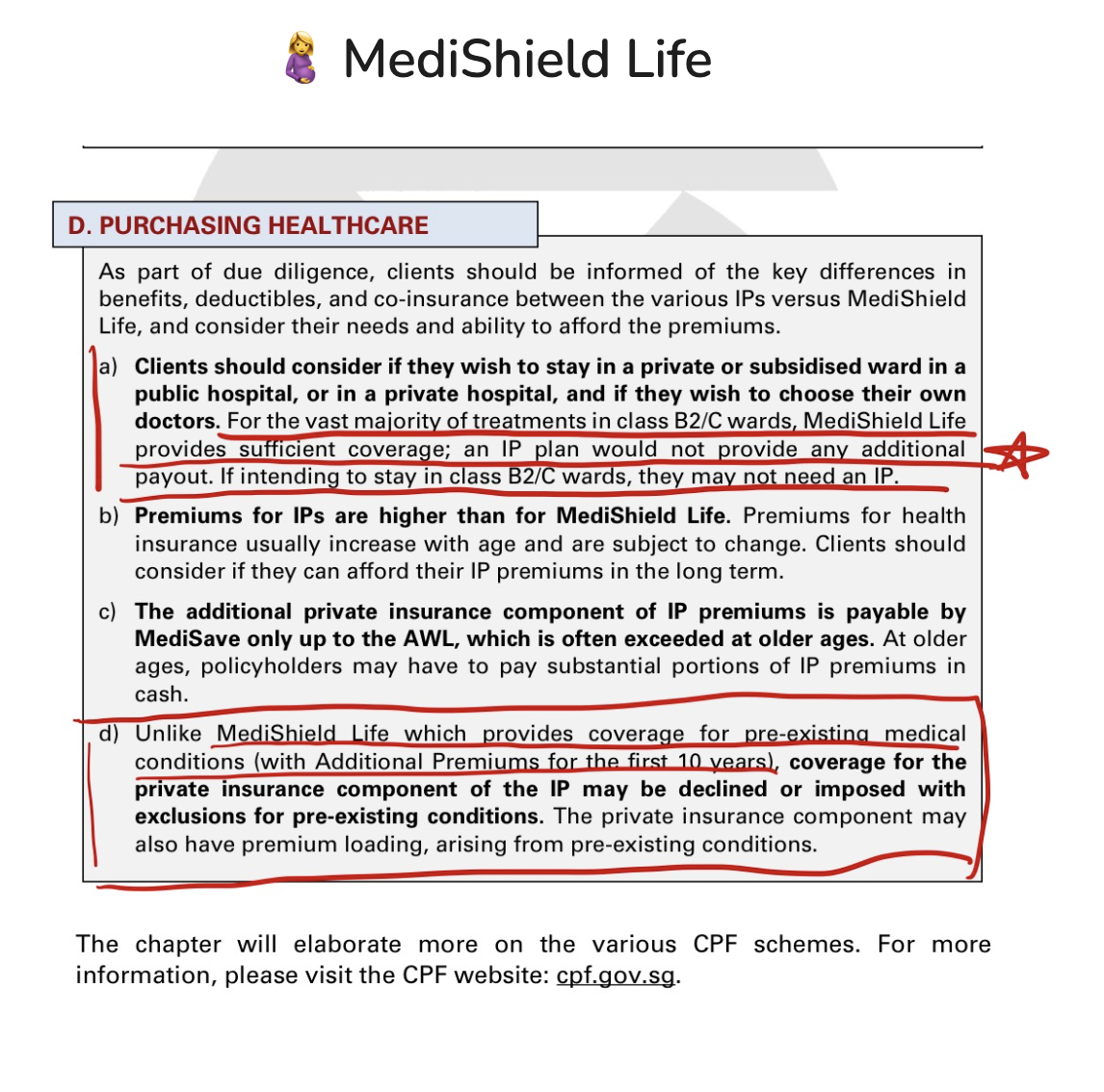

First, choosing the right medical resource can help. Government hospitals provide significant subsidies, and Singaporean newborns are automatically enrolled in MediShield Life without medical underwriting, which includes coverage for congenital conditions (see Figure 5). For pregnancies at risk of premature delivery, private doctors may also advise transferring to public hospitals based on the family’s financial situation.

Additionally, even if a child experiences medical issues at birth, it may still be possible to obtain IP hospitalisation insurance later. For example, my son underwent treatment for Kawasaki disease and related coronary artery complications for two years. After six months of full recovery, he successfully enrolled in both hospitalisation and critical illness insurance — without any exclusions.

Conclusion

In the end, I chose not to purchase any maternity insurance — but that’s my personal choice.

If your financial resilience is lower — for instance, if the mother lacks basic life and hospitalisation insurance and additional protection brings peace of mind — maternity insurance may be worth considering.

If your newborn doesn’t automatically qualify for MediShield Life, or if you feel extra hospitalisation coverage is essential, maternity insurance can provide guaranteed admission (though still with certain exclusions).

If you’re already planning to purchase life insurance, maternity insurance as a rider may also be an option. And if your financial capacity allows, high-end international medical insurance can be another solution.

Reference

- Exclusion clauses in different maternity insurance policies

- MediShield Life

Read More

Insurance for Kids

A practical guide to children's insurance focusing on essential hospitalisation and critical illness coverage while avoiding unnecessary policies.

Private Property Budgeting and Buying Strategy

Our strategy for selling our first condo and buying a second property, with budgeting principles to avoid financial strain and maintain investment flexibility.