Singapore’s income tax system is relatively streamlined, but there are quite a few tax relief clauses, most of which apply to families with children and elderly dependents. For dual-income households, reasonable planning can save a lot of tax. I’ve always used a simple Google Sheet to calculate family income tax, and the results are almost always consistent with the actual tax paid. Here are some tips to share.

♟️ List All Tax Relief Items

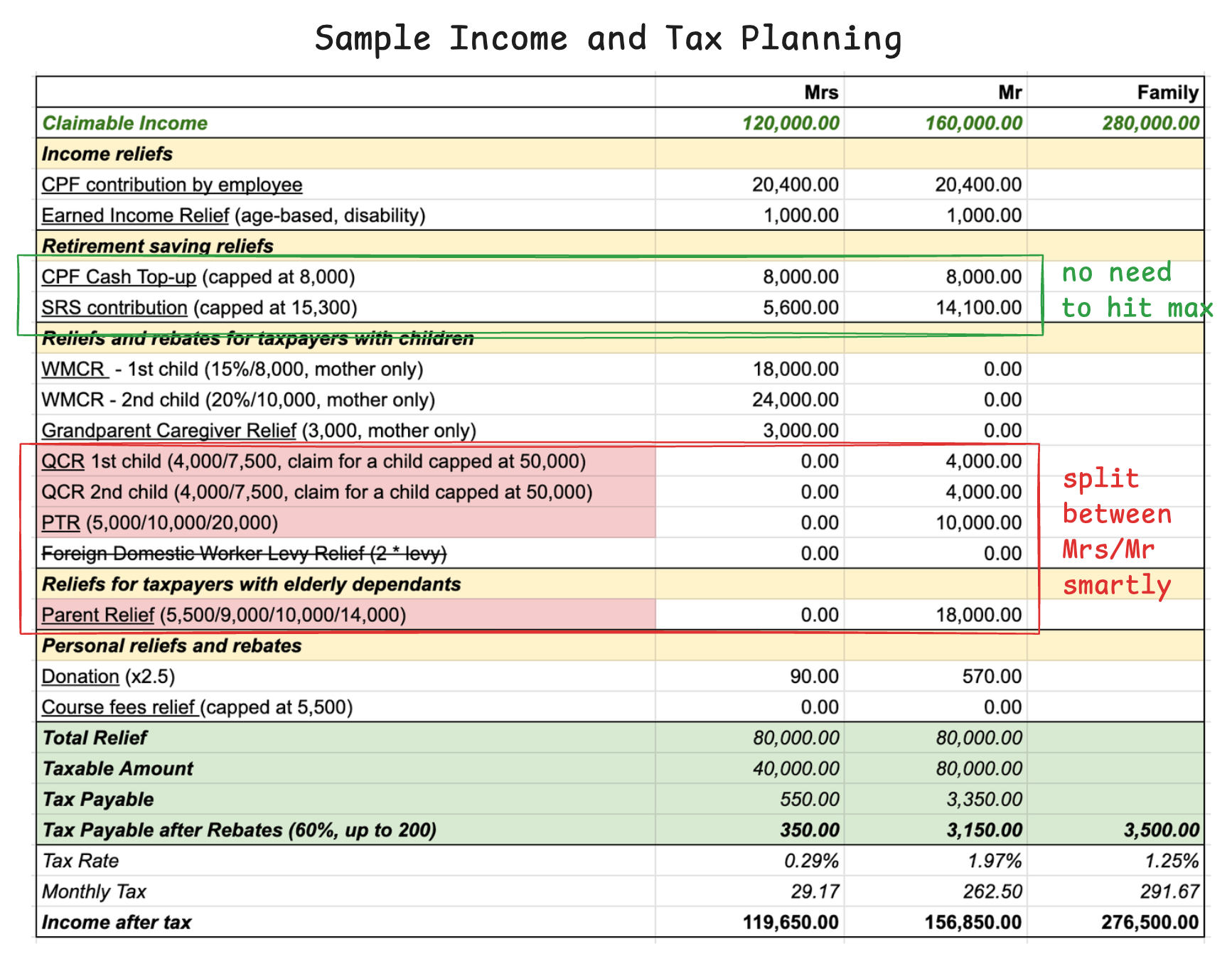

The calculation sheet lists all relevant tax relief items and links to the corresponding policies. If you need to understand the details of a relief policy, you can easily check, for example:

- The relief amount for Working Mother’s Child Relief (WMCR) was adjusted after 2023;

- Foreign Domestic Worker Levy (FDWL) Relief ended after 2025;

- The income cap for Parent Relief for co-residing parents was doubled in 2025, etc.

♟️ QCR, PTR, Parent Relief Allocation

For families with children and co-residing parents, these items can be allocated between both spouses. Generally, since mothers have working mother and caregiver tax benefits, more of these can be allocated to the father. But it’s not absolute—if the mother’s income is particularly high and falls into a higher tax bracket, and the total of other items hasn’t reached the $80K cap, it might be more cost-effective to allocate to the mother.

List the family’s total tax rate so you can more intuitively see how adjusting the allocation affects overall tax.

♟️ CPF and SRS Top-Ups

Topping up CPF and SRS can both reduce taxes. But since the topped-up amount loses liquidity, don’t top up blindly.

Another consideration is whether you need to top up fully—if other reliefs have already reached the $80K cap, there’s no need to top up further. So I usually calculate and review at the end of the year, and if needed, transfer some long-term investment funds into CPF or SRS to continue similar investments.

CPF and SRS each have their own liquidity advantages. Personally, I prefer to max out CPF first, then supplement with SRS for tax relief, since I have enough emergency savings and other investments, so liquidity isn’t a main concern. But this varies by person—if you’re more sensitive to liquidity, SRS at least allows withdrawals with a penalty, while CPF can only be accessed at age 55.

♟️ Donation Tax Relief

Donations are eligible for 2.5 times tax relief. Some companies encourage employees to participate in social causes and have matching donation policies. If your company matches 1:1, donating $100 yourself is equivalent to $500 in tax relief. At a 20% tax rate, you can save $100 in tax, which means all the tax you would have paid on this portion is instead donated (reference: $200k–19%, $240k–19.5%, $280k–20%). For higher-income individuals, whether to give similar amounts to charity or pay taxes is a personal choice.

Reference

Read More

Should I Include Singapore Property in My Investment Portfolio

Analyzing Singapore property investment returns vs S&P 500 and REITs: data-driven case study with Python calculations comparing expected returns.

Agent Theory, Incentivisation and Insurance commission rebate

The greatest value of financial markets lies in the optimal allocation of resources across time and space. Here's some thoughts about agent theory, incentivisation and insurance commission rebase learnt from Coursera course - Financial Market by Yale