Previously, I wrote about insurance and financial planning needs for the elderly. One of the most important needs is a steady stream of passive income. This article shares my perspective on planning passive cash flow in retirement.

Here are common passive income sources available to most working individuals:

💰 CPF LIFE (government annuity scheme)

💰 Commercial annuities

💰 Interest from cash savings

💰 Bond interest payments

💰 Dividends from high-yield stocks (e.g., blue chips, REITs)

💰 Capital appreciation from growth stocks or indices (e.g., S&P 500 ETFs, MSCI ETFs)

💰 Rental income from real estate

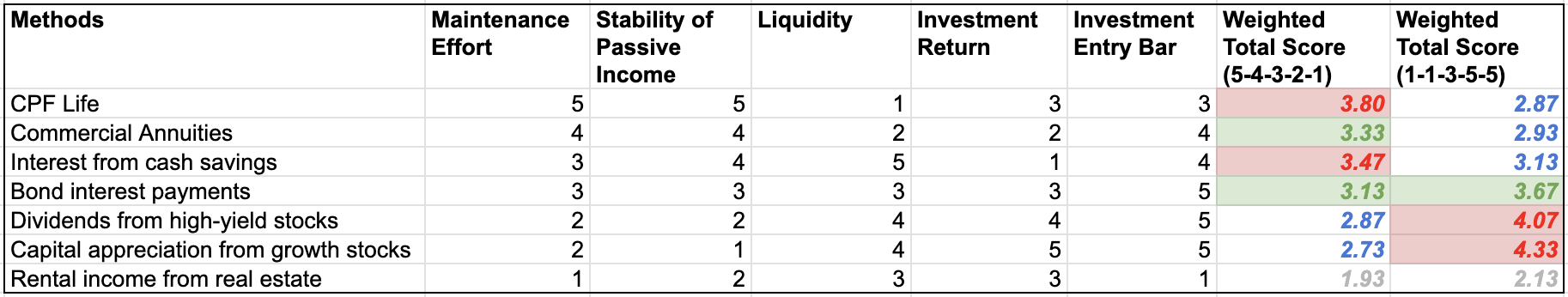

To evaluate each method for retirement (and wealth accumulation), I assess them across five dimensions:

- Maintenance effort

- Stability of passive income

- Liquidity

- Investment return

- Entry barrier (investment threshold)

Analytics

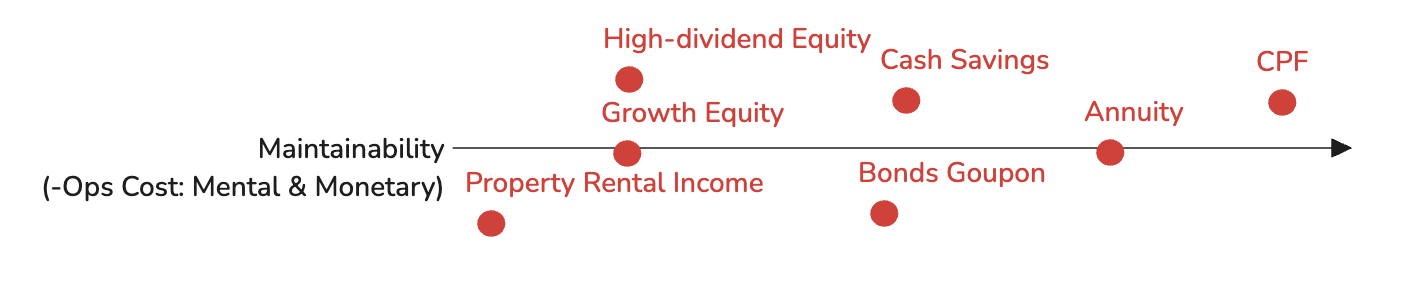

Maintenance Effort (Low Maintenance = Better)

Why is low maintenance important for retirement planning?

After reading My Money Journey, which shares retirement planning stories from seniors and their children, one major takeaway is: don’t overestimate your capabilities in old age. As physical and cognitive function decline, managing complex investment portfolios becomes increasingly difficult. Seniors are also more sensitive to market volatility. At that point, a reliable, low-maintenance income stream is far more important than chasing high returns.

| Source | Analysis | Score |

|---|---|---|

| CPF LIFE | Backed by the government, provides lifetime income, lowest maintenance | 5 |

| Commercial annuities | Also low maintenance, but product design is more complex with fixed and floating components | 4 |

| Cash savings interest | Low maintenance, but may require effort to manage fixed deposits or meet account requirements | 3 |

| Bond income | Requires analysis and transaction management | 3 |

| High-dividend stocks | Requires account management and portfolio upkeep | 2 |

| Growth stock index returns | Requires monitoring, strategy, and withdrawal decisions | 2 |

| Property rental | Highest maintenance: taxes, maintenance, agents, tenant management | 1 |

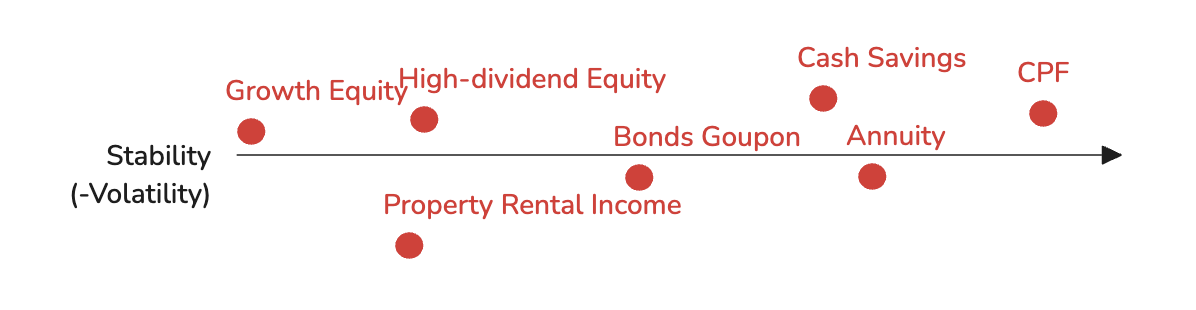

Stability of Passive Income (Low Volatility = Better)

Stability is crucial for retirees. Volatile income leads to uncertainty, which affects confidence in spending. If income varies too much, people may reduce consumption, even when it’s unnecessary.

Volatility in capital is also important. For instance, if you rely on selling growth stocks for cash flow, market downturns may force you to sell more shares at lower prices, undermining capital sustainability. InvestmentMoats once simulated a 2000-retiree scenario (through dot-com bust and financial crisis): a 100% S&P500 portfolio retained only 15% of principal after 20 years, while a 60/40 stock-bond portfolio retained 80%.

| Source | Analysis | Score |

|---|---|---|

| CPF LIFE | Most stable due to its non-profit, government-backed nature | 5 |

| Commercial annuities | Offers relatively stable cash flow, some have variable components | 4 |

| Cash interest | Fluctuates slightly with economic conditions, generally stable | 4 |

| Bond income | May fluctuate with default risk and rate cycles | 3 |

| High-dividend stocks | Dividends vary by company, sector, market cycle | 2 |

| Growth stock appreciation | Stocks are historically the most volatile | 1 |

| Property rental | Rent depends on market demand, policies, property condition | 2 |

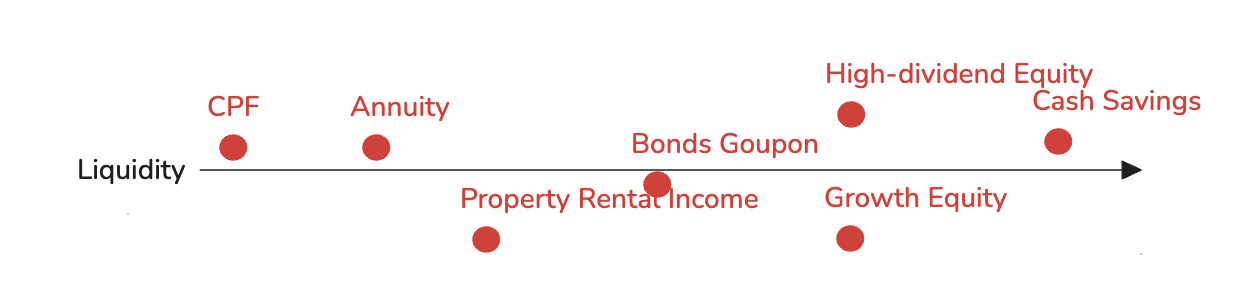

Liquidity

Liquidity is important in retirement for unexpected large expenses — especially healthcare and home repairs, which are often underestimated but significant. Singapore’s apartment-style housing reduces maintenance costs compared to landed property, but aging facilities and high labor costs still matter.

| Source | Analysis | Score |

|---|---|---|

| CPF LIFE | Not liquid | 1 |

| Commercial annuities | Low liquidity; high surrender costs | 2 |

| Cash savings | Highly liquid and flexible | 5 |

| Bonds | Medium liquidity, depending on maturity | 3 |

| High-dividend stocks | Liquid with minor delays (settlement days) | 4 |

| Growth stock returns | Liquid, similar to above | 4 |

| Property rental | Low liquidity due to long transaction time | 3 |

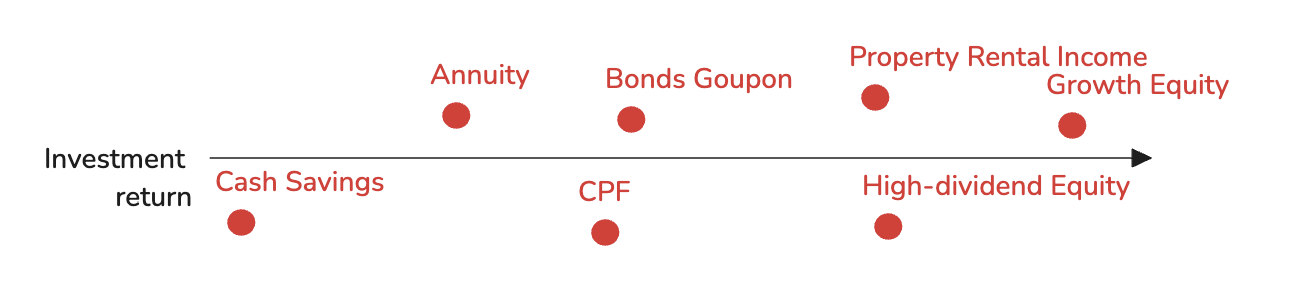

Investment Return

Returns matter at all stages — but unfortunately, higher returns usually come with higher volatility. In retirement, people often trade some returns for stability. Younger investors can afford more volatility in pursuit of higher long-term growth.

| Source | Analysis | Score |

|---|---|---|

| CPF LIFE | ~4% return (based on CPF RA). Payouts include “mortality credits” due to risk pooling — initial payout rate ~5-6%, which is high for risk-free instruments | 3 |

| Commercial annuities | Typically 3-4.5%, split into fixed and variable components, no mortality credits | 2 |

| Cash interest | 2-3%, depending on rates | 1 |

| Bonds | 4-5%, depending on risk | 3 |

| High-dividend stocks | 5-6% annual yield (e.g., SG blue chips, REITs) | 4 |

| Growth stock appreciation | S&P 500 historical avg >7% | 5 |

| Property rental | 3-4% yield, some appreciation potential | 3 |

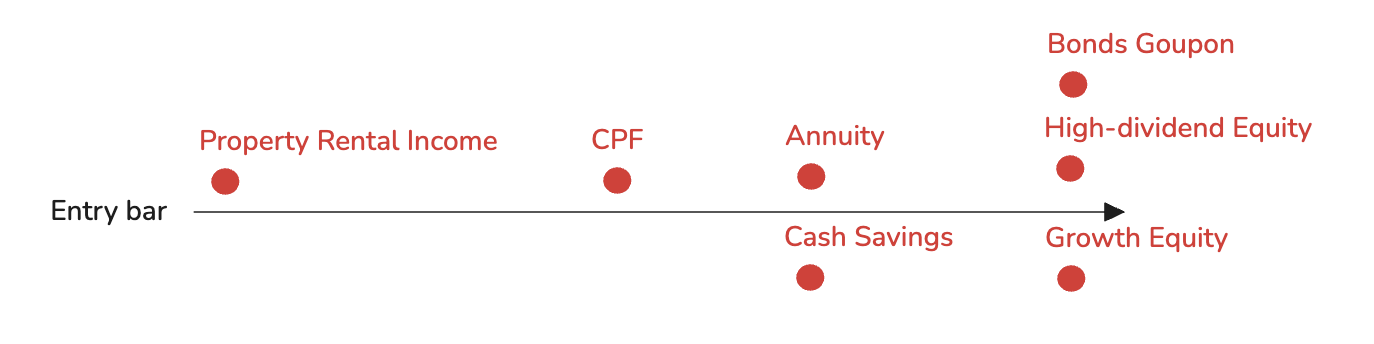

Investment Entry Bar

This considers how much capital is required to start. All of the above are accessible to regular workers, though property investment generally requires a large sum. This matters more during early accumulation than in retirement.

| Source | Analysis | Score |

|---|---|---|

| CPF LIFE | Not high, but requires long-term CPF savings and policy-based limitations | 3 |

| Commercial annuities | Many low-entry options, flexible designs | 4 |

| Cash savings | Highly flexible, with better rates at higher balances | 4 |

| Bonds | Low entry threshold | 5 |

| High-dividend stocks | Low entry threshold | 5 |

| Growth stock index | Low entry threshold | 5 |

| Property rental | High threshold, may require leverage and good credit | 1 |

Summary

If we apply weights to each category based on retirement needs (maintenance > stability > liquidity > return > threshold), each investment type gets a weighted score.

- Annuities (especially CPF LIFE) are the best option for retirement. They offer the most stability and require almost no maintenance — even though returns may be modest.

- Cash reserves (via savings accounts, fixed deposits, money market funds, bonds) offer steady income and liquidity — a smart choice at any stage.

- Younger investors should focus on growth and high-dividend stock ETFs for wealth accumulation — rather than low-yield, low-liquidity options like commercial annuities or endowment plans.

- Property investment can be underwhelming. While it has advantages like leverage and diversification from financial assets, investment properties beyond your own home must be approached cautiously. As I’ve written before, I’ll only consider property investment after building a strong financial portfolio — and even then, I’ll limit property to no more than 30% of total assets.

Of course, all this is based on my personal understanding and risk tolerance. Others may have different views — some may excel in real estate investing and leverage knowledge for excess returns; others may prefer lower volatility and are willing to trade return for peace of mind. Ultimately, it’s a personal choice.

Read More

Investment Mindset that Inspires Me

Plan your life goals first, then plan your finance towards that; Live below your means; Buy term life and health insurance, that's it, then forget about insurance

My Financial Review 2025 - The Financial Habits That Paid Off

As 2025 comes to a close, I reflect on what worked in my personal finances. Here I break down my passive investing approach, key lessons from recent years, and the savings, asset allocation, and debt goals guiding my 2026 plan.