As 2025 draws to a close, it’s a natural moment to look back on the year behind us and think ahead to what’s next. When it comes to personal finance, this annual reflection is more than a routine check-in—it’s a powerful habit that helps build long-term wealth and keeps life goals within reach.

My investment approach is firmly rooted in passive investing. I don’t chase excess returns, so my performance largely mirrors the broader market. Because of that, any single year’s return—good or bad—doesn’t carry much meaning on its own.

Instead of setting short-term return targets, I focus on savings goals tied to long-term investment objectives. Each year, I adjust my cash position, liabilities, and portfolio allocation to stay aligned with those goals rather than reacting to market noise.

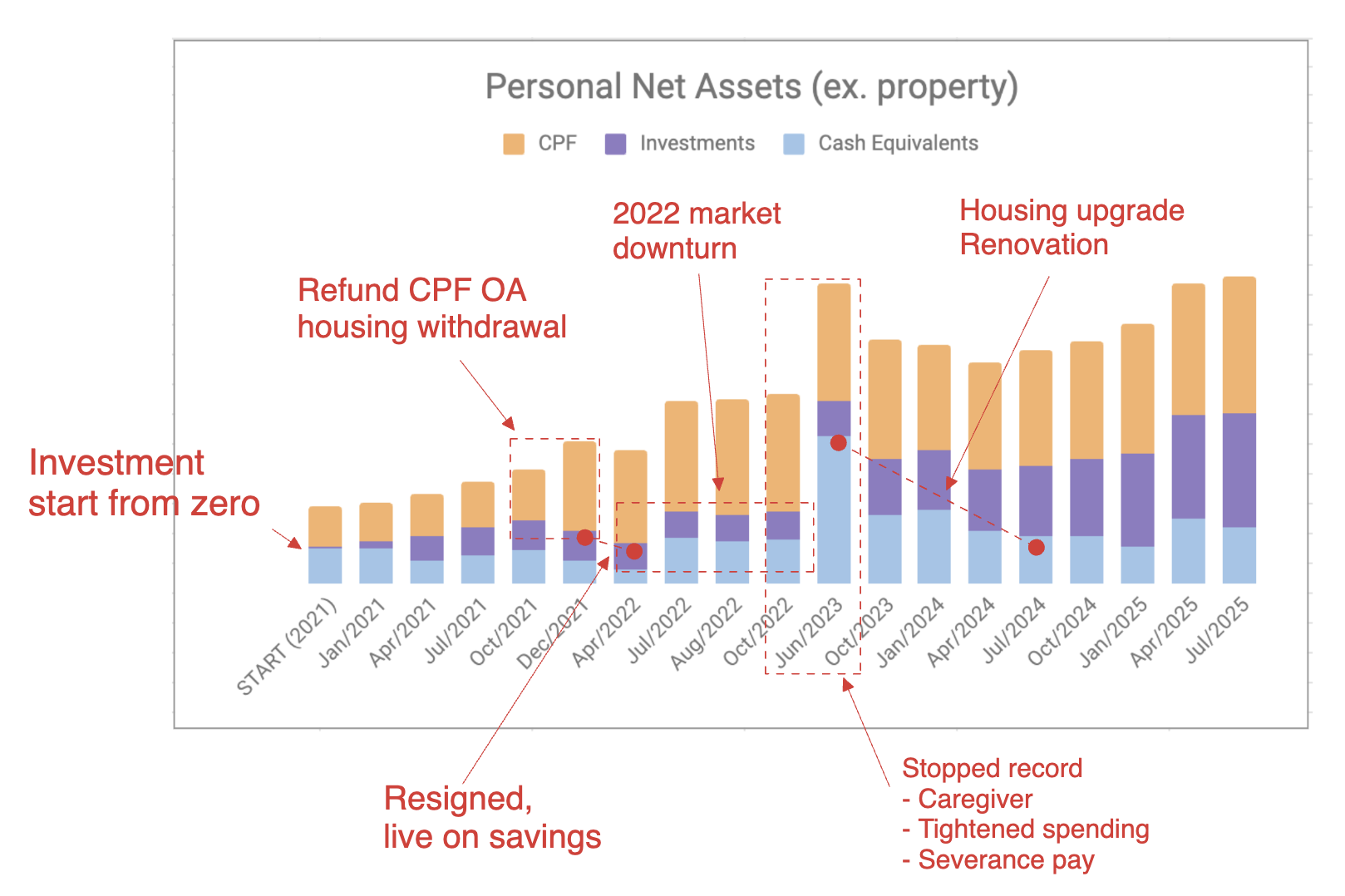

2021–2023: Reflection and Course Correction

When I reviewed my net worth changes from 2021 to 2023, a few weaknesses became clear:

- Financial asset accumulation was slower than expected

- Cash and low-risk investments made up too large a share of assets

- Large cash inflows weren’t invested promptly

- Owner-occupied real estate dominated total assets

- The financial market downturn in 2022 coincided with a surge in real estate

- Overall debt levels were relatively high

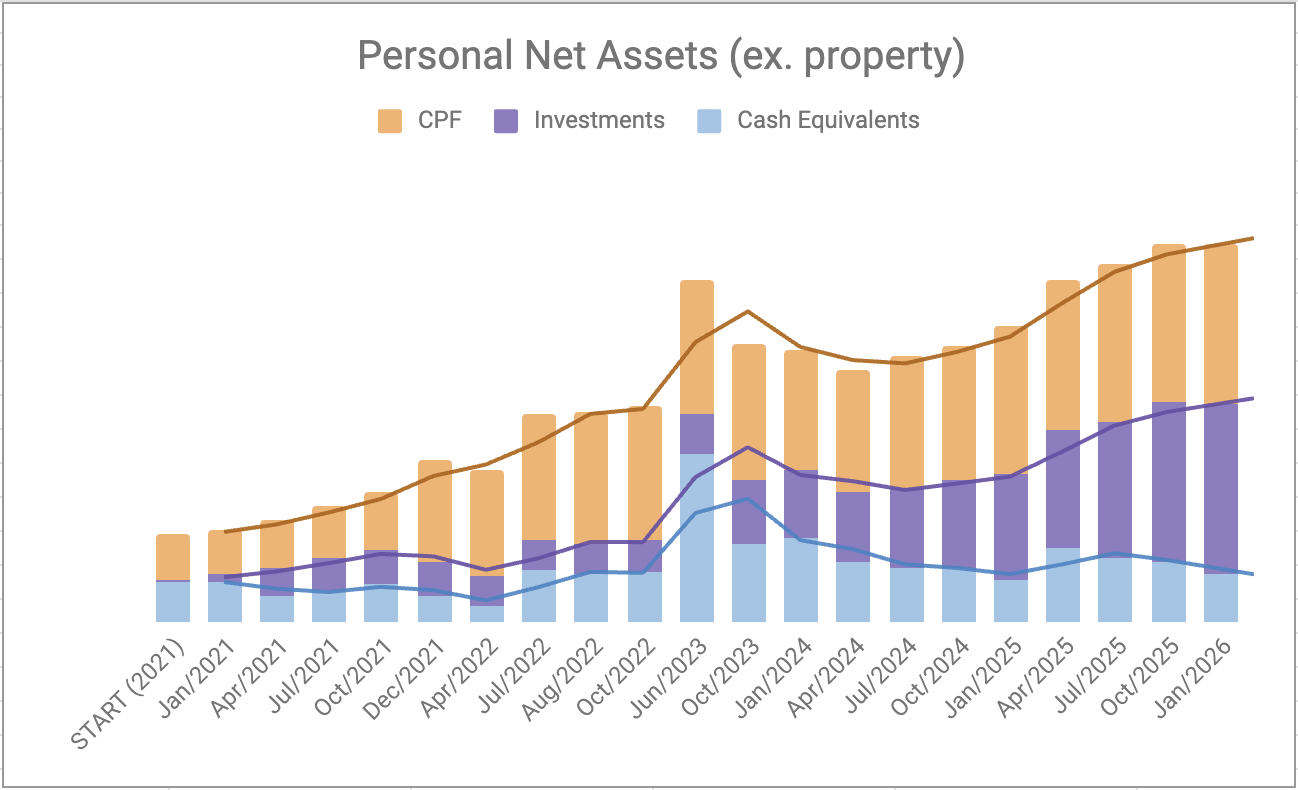

In response, I set a three-year investment and wealth management plan for 2024–2026. After several steady years of execution, I’m happy to say that most of these goals were already achieved by 2025:

- Savings rate above 50% 👌🏻

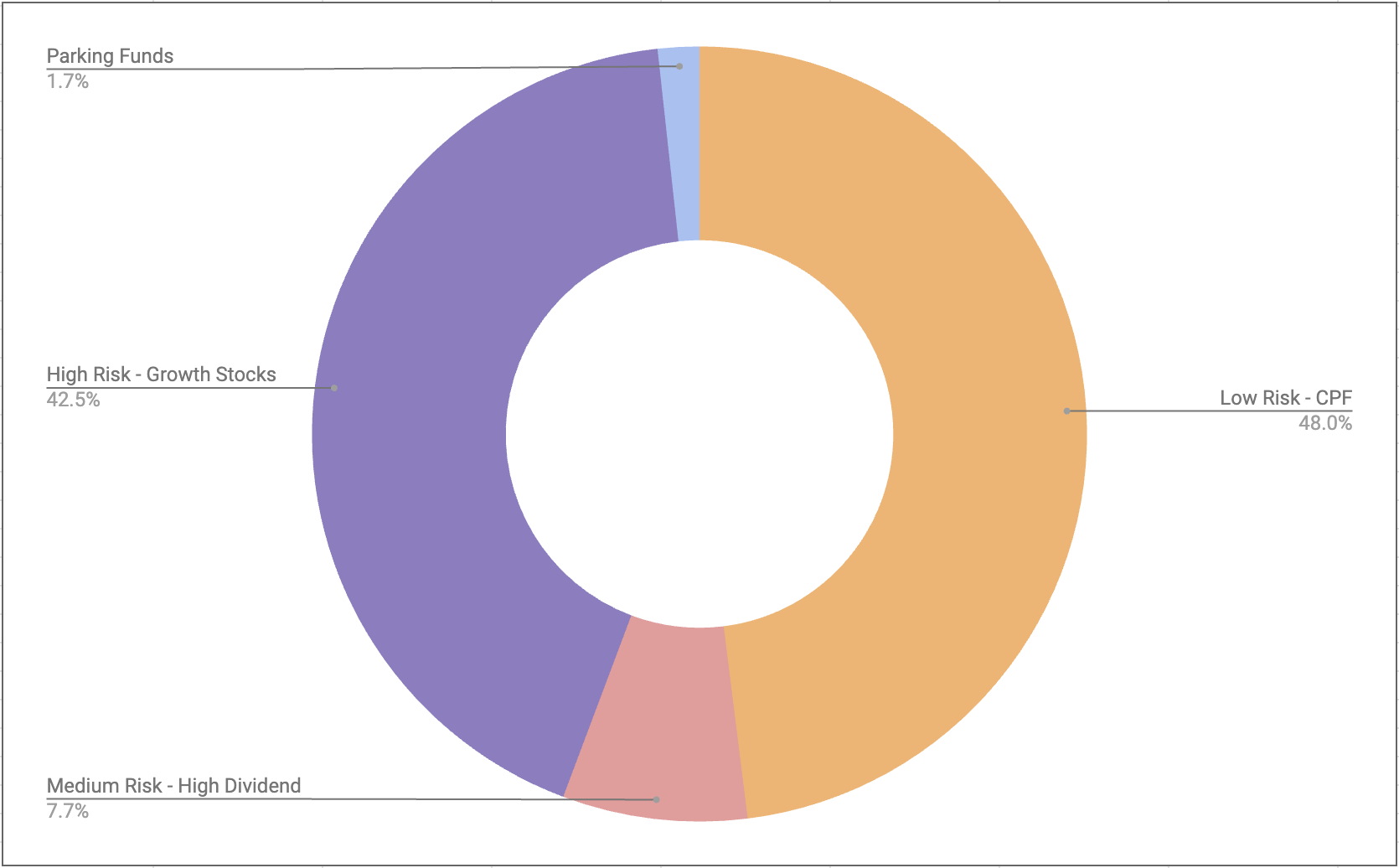

- Stock-to-bond ratio above 40% 👌🏻 (25% → 52%)

- Debt ratio below 35% 👌🏻 (42% → 35%)

- Real estate below 50% of total assets 👌🏻 (60% → 45%)

These improvements didn’t come from dramatic changes, but from consistent, disciplined decisions made year after year.

New Year Resolutions for 2026

This year also brought a major life change—we welcomed a new family member. With higher expenses on the horizon, I plan to track spending more closely for a period of time to build more accurate budgets and set a realistic savings rate. As a result, my target savings rate has been adjusted slightly downward.

On the investment side, I’ll continue increasing exposure to higher-risk assets and gradually raise my stock-to-bond ratio. I also plan to introduce a small allocation to cryptocurrency. After reviewing my asset allocation and long-term goals, ChatGPT suggested keeping this exposure below 5%, which aligns well with my risk tolerance.

My 2026 Investment & Wealth Management Goals:

- Track expenses in greater detail

- Allocate less than 5% to cryptocurrency

- Increase emergency fund savings (partially via money market funds)

- Maintain a savings rate above 40%; save 50% of additional income

- Raise the stock-to-bond ratio above 55%

- Reduce the debt ratio below 30%

Happy saving, happy investing—and most importantly, happy living.

Read More

A Path to FIR(E)

Agent Theory, Incentivisation and Insurance commission rebate

The greatest value of financial markets lies in the optimal allocation of resources across time and space. Here's some thoughts about agent theory, incentivisation and insurance commission rebase learnt from Coursera course - Financial Market by Yale